- Institutional appetite for Bitcoin combined with strong whale demand underpin recent BTC upside.

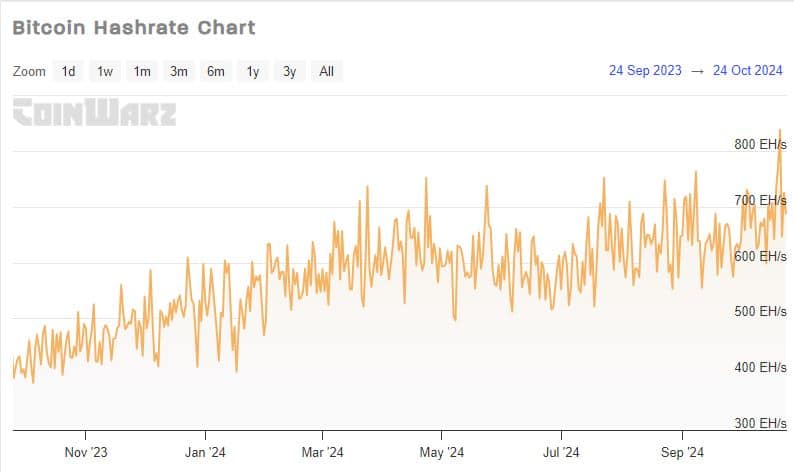

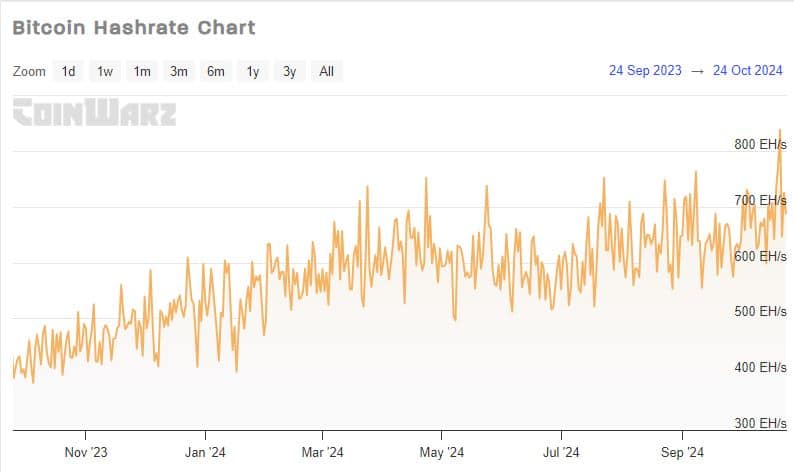

- Bitcoin hash rate’s recent new ATH signals the state of activity around the cryptocurrency.

Bitcoin [BTC] has been showing signs of increased activity especially in the whale and institutional classes. These two categories arguably have the biggest impact on BTC’s price movements.

Bitcoin has maintained a strong upside in the last six weeks after previously struggling to stay above $60,000. This latest rally has been smoother than usual and that was likely due to strong institutional involvement.

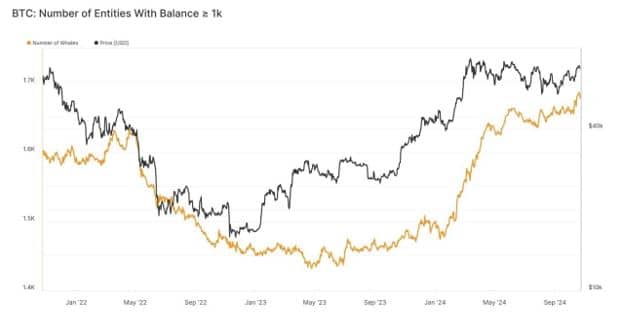

The shifting sentiment around BTC made it more appealing as evident by the surge in institutions holding the cryptocurrency. Glassnode data recently revealed that entities holding over 1,000 BTC recently pushed above May 2022 levels.

Source: Glassnode

The same category of Bitcoin holders previously saw significant decline which leveled out in May last year. This means they have been aggressively accumulating, but momentum seems to have slowed down between May and August.

Bitcoin whale holdings soar to new highs

The pace of upside appears to have regained an upward trajectory since September. This also aligns with data on whale activity which has also been soaring.

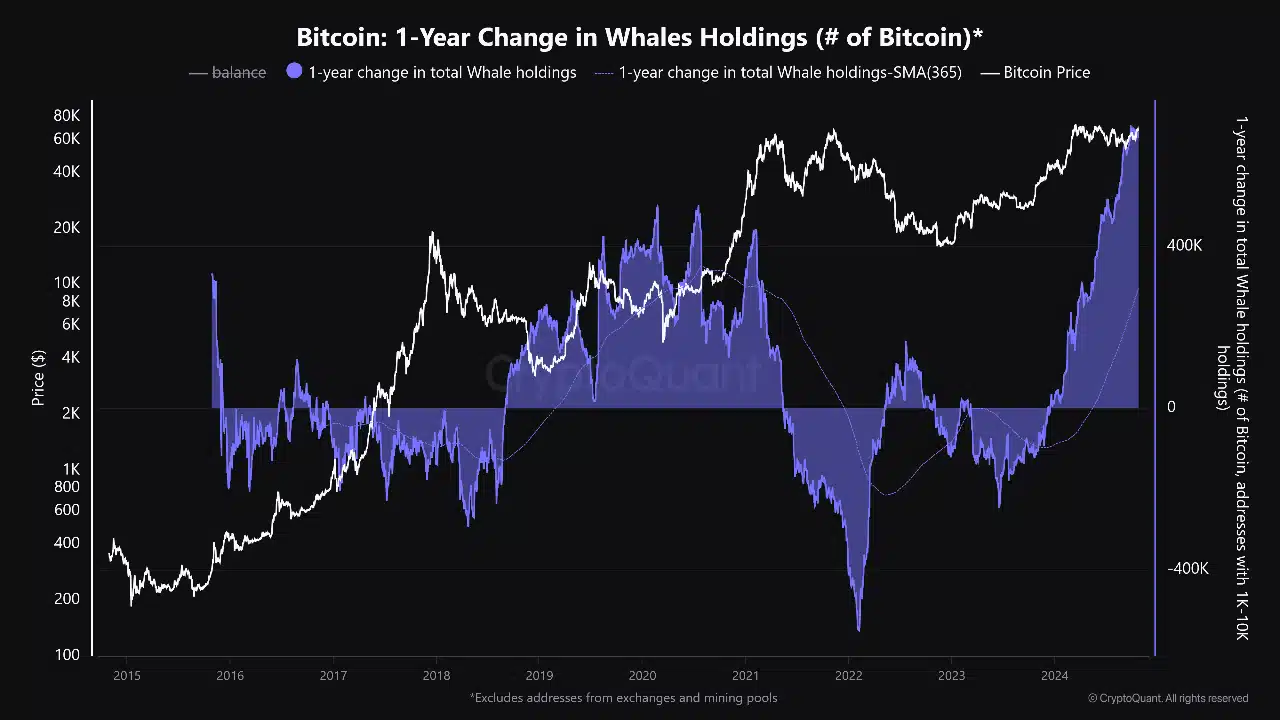

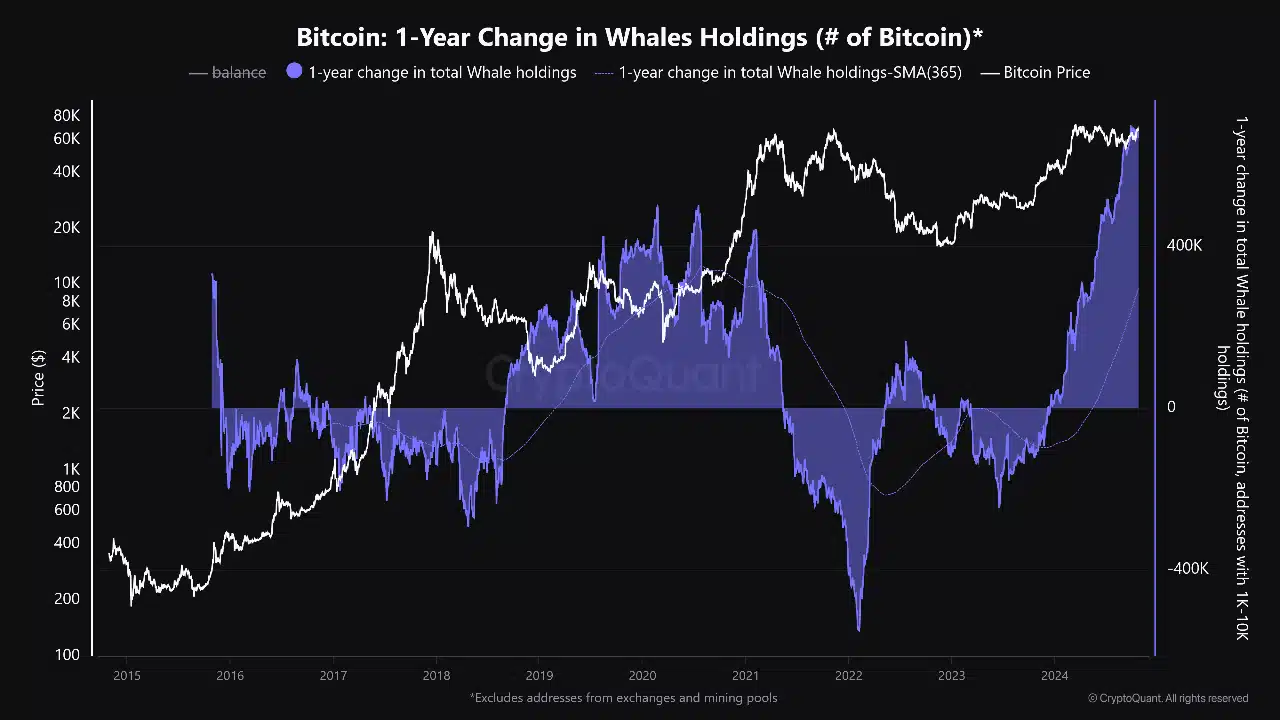

Bitcoin whales reportedly held over 670,000 BTC as per the latest data, which is the highest amount that the whale category has ever held. CryptoQuant analyst BaroVirtual described the observation as a sign of accumulation before a major move.

Source: CryptoQuant

The Bitcoin whale holdings pivoted in 2023 and the continued accumulation recently pushed above 2021 highs.

One of the most common observations on both institutional and whale activity is that it has been growing rapidly in the last 2 months. Bitcoin-related transactions have thus been higher, necessitating more network capacity.

Bitcoin miners have responded to the surge in network activity by boosting their operations. As a result, the Bitcoin hash rate recently pushed to its highest level at 918.72 TH/s.

Source: Coinwarz.com

The network achieved this feat on Monday, 21st October, this week. The hash rate ATH suggests that miner profitability has been quite high.

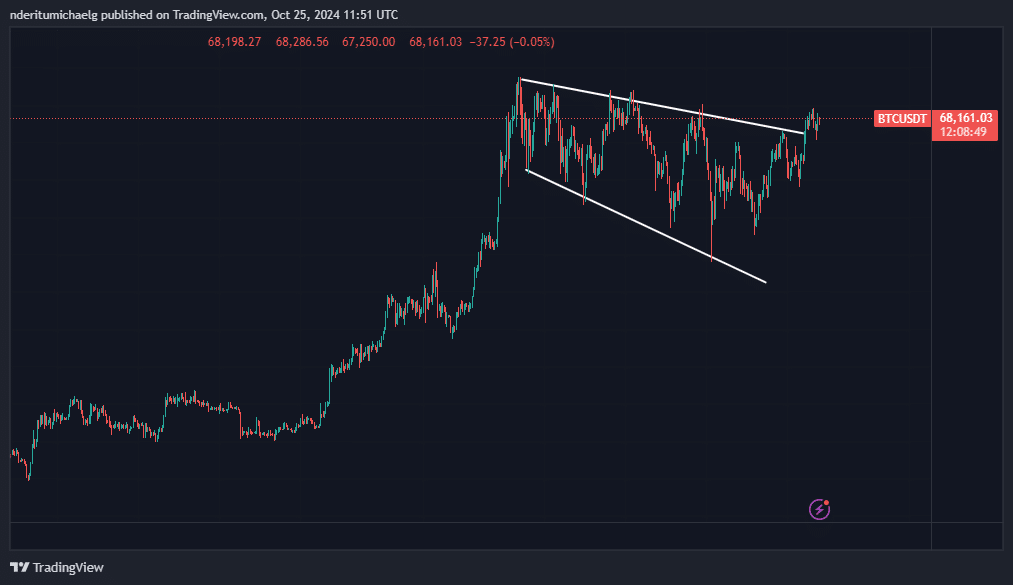

Meanwhile, the impact of the latest surge in demand for BTC was evident in the price action. Bitcoin has been moving within a bullish flag pattern since March.

Is your portfolio green? Check the Bitcoin Profit Calculator

The latest bullish momentum appeared to have pushed it above the resistance range, suggesting that more potential upside may occur in the coming months.

Source: TradingView

Whale and institutional accumulation may suggest big moves on the way. However, these observations also implied the possibility that Bitcoin may experience extremely volatile moves in the short-to-mid term.