- UNI’s tightening Bollinger Bands and RSI nearing overbought suggest a potential breakout above $8.38.

- Market sentiment remains positive as large transactions and open interest show bullish momentum.

Uniswap [UNI] has firmly established itself as a leader in decentralized finance, processing over $2.4 trillion in trading volume and generating more than $8 billion in economic value. With an impressive $2.7 billion in gas fees paid, its significance within Ethereum’s ecosystem is unquestionable.

Trading at $8.02, up 3.23% at press time, UNI has been catching traders’ attention. But the question remains—can UNI break out of its recent range and trigger a bullish rally?

UNI chart analysis: Nearing a critical point?

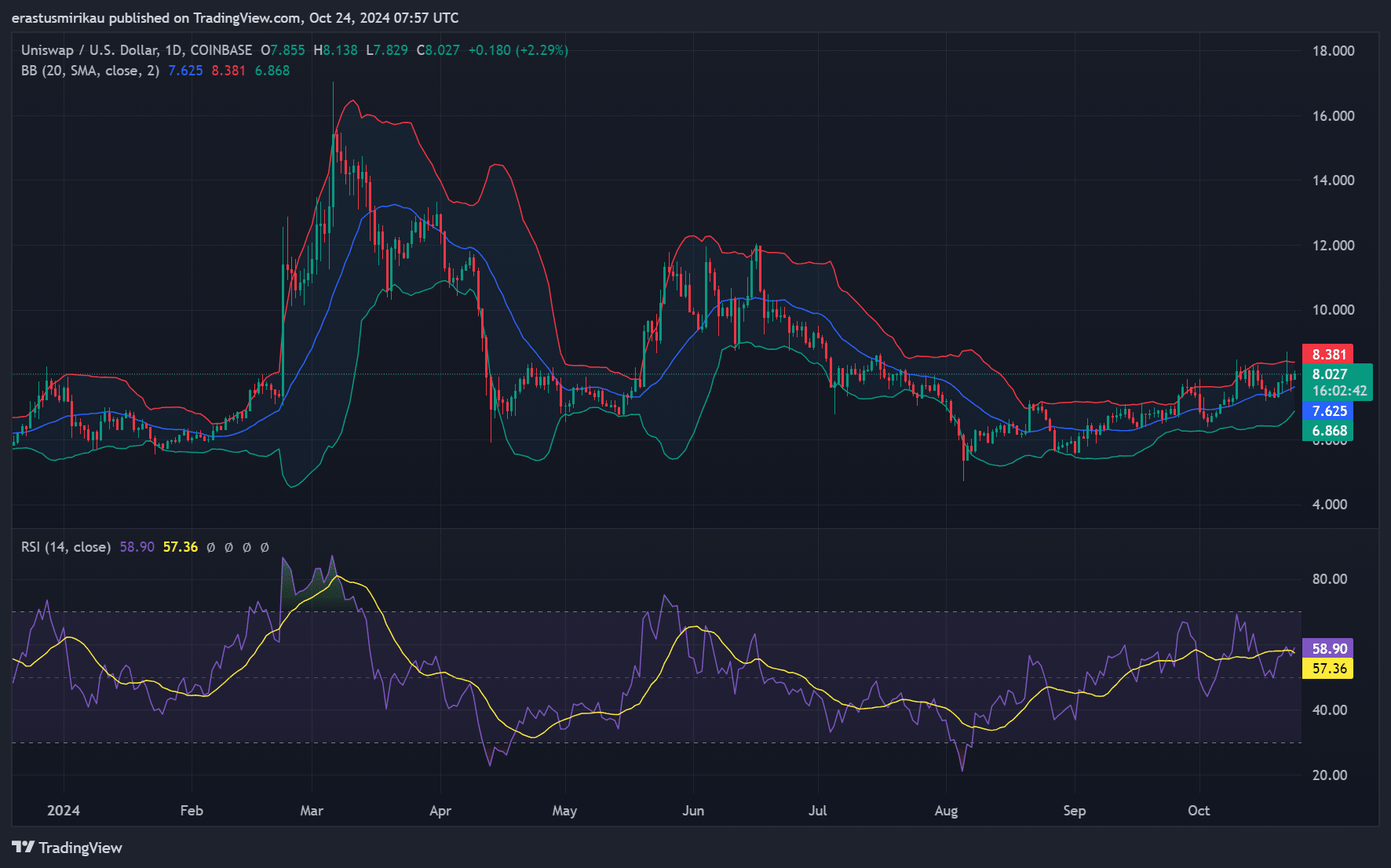

Looking at the daily chart, UNI has seen consistent consolidation within a narrow range for the past few months. Bollinger Bands indicate that the price has been tightening, which often signals an imminent breakout.

Additionally, the Relative Strength Index (RSI) is at 58.90, just shy of overbought territory, suggesting that UNI could see further upward movement if buying pressure persists.

However, if the token fails to break through the $8.38 resistance, it could face continued sideways action, or worse, a retracement.

Source: TradingView

On-chain signals: Mostly bullish, but is it enough?

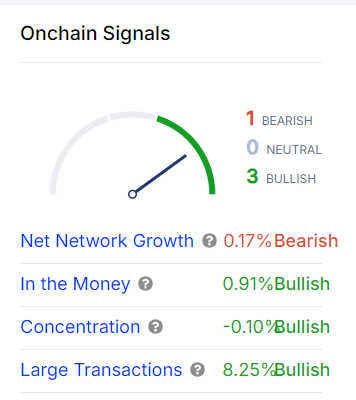

The on-chain data for UNI presents a compelling, mostly bullish case. The “In the Money” metric shows that 0.91% of all addresses are profitable, indicating positive sentiment among investors.

Additionally, large transactions have increased by 8.25%, signaling growing interest from larger investors. This is a promising indicator of potential bullish momentum.

However, there’s a slight hiccup—net network growth, though only down 0.17%, shows some hesitation in new participants joining the network. Therefore, while the on-chain data supports a bullish outlook, this slight dip in growth is something to watch.

Source: IntoTheBlock

Open interest analysis: A surge in activity

UNI’s open interest is also climbing, up 3.91%, bringing the total to $122.69 million. Consequently, more traders are opening new positions, and this often serves as a precursor to increased volatility.

With open interest on the rise, coupled with the technical indicators and on-chain metrics, the possibility of a bullish breakout becomes increasingly likely.

Source: Coinglass

Is your portfolio green? Check out the UNI Profit Calculator

Considering the technicals and on-chain signals, UNI appears poised for a breakout.

While the slight drop in network growth raises caution, the growing open interest and strong performance in other metrics suggest that UNI may soon break through its current resistance levels.