- Aave breaks above a descending trendline resistance.

- Aave’s outperformance of other lending protocols to add momentum.

Aave’s [AAVE] recent performance on the charts has been impressive, particularly on the 4-hour timeframe, where it broke out of a descending triangle.

This breakout signals the continuation of the uptrend that began in August. After a 2-year consolidation, Aave’s price is now on the rise, with today’s price surge of over 5%, bringing it above the $160 mark.

This breakout from accumulation suggests it’s primed for a move toward the $200 level, a key target it failed to hit during its initial breakout.

If market momentum persists, it could surpass this level before the end of the year.

Source: TradingView

It’s USDT pair reveals the recent rejection at the $135 level three times. The third attempt led to a breakout above the upper trendline of the descending triangle, adding further confidence in a move higher.

With Bitcoin reclaiming the $64K level, it has set the stage for altcoins to rally in the final quarter of the year.

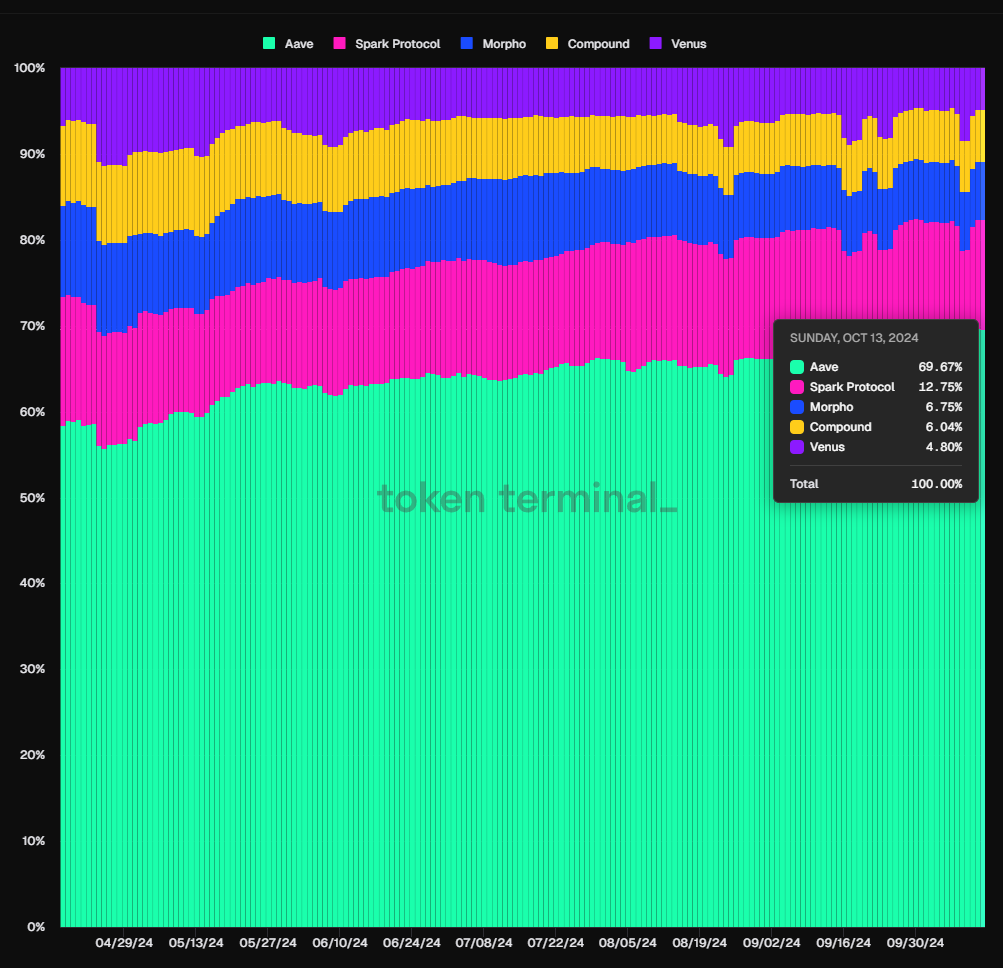

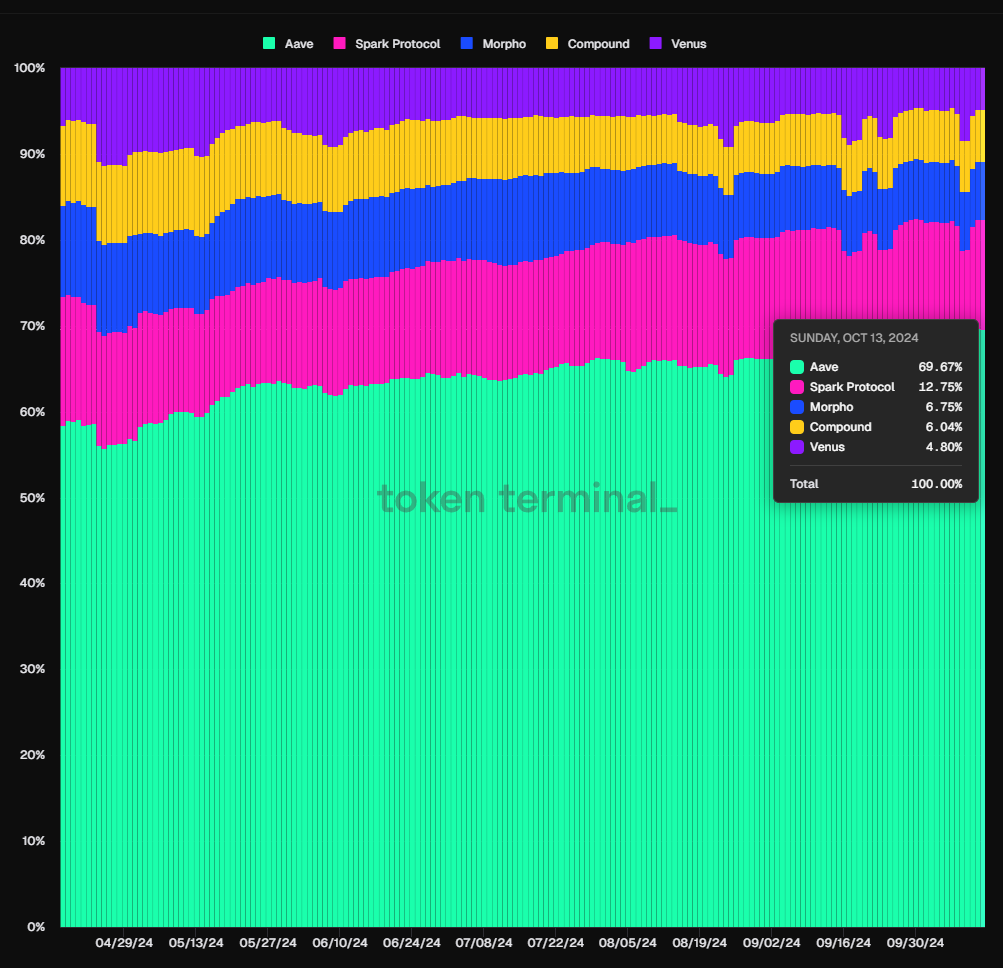

Aave’s active loans share

Aave’s dominance in the DeFi lending space has continued to grow.

Over the past six months, Aave’s share of active loans has risen from 58% to 70%, positioning it as a key player in the market.

Aave’s Sky Force dominance increased from 70% to 83%, showing that the token is gaining traction and potentially on track for a run beyond $200, driven by its lending success and market momentum.

Source: Token Terminal

Whale activity

Whale activity is also supporting the bullish outlook. Recently, a whale made significant purchases, accumulating 47,991 AAVE worth $7.45 million.

This whale first bought 31,173 tokens, worth $4.8 million, and later added another 16,818, worth $2.59 million, signaling strong confidence in AAVE’s future performance.

The whale’s actions suggest that a move toward the $200 level is likely, even as market conditions remain unpredictable.

Source: Lookonchain

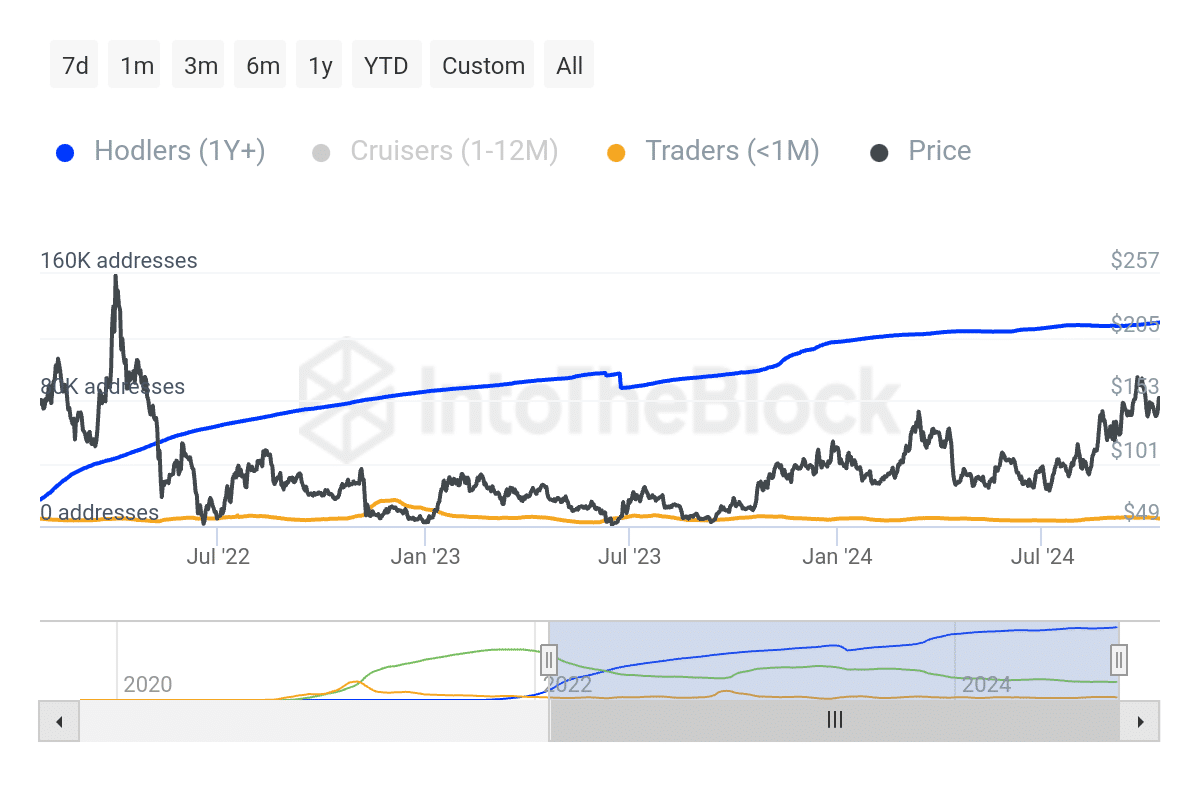

Long-term holders have been steadily increasing

Additionally, the holder composition further supports a bullish outlook. Long-term holders have been steadily increasing since July 2022, while short-term traders have been decreasing.

This shift indicates that weaker hands are leaving, while more confident long-term holders remain.

With fewer short-term traders, there may be reduced sell pressure, allowing the token’s price to rise more easily.

Source: IntoTheBlock

Read Aave’s [AAVE] Price Prediction 2024–2025

All signs point towards a move higher, with a potential rally past $200 before the year’s end.

Aave’s strong market position, whale accumulation, and increasing long-term holder base suggest that the upward trend is poised to continue.