- Ethereum setting for a reversal on its BTC and USD pairs

- Market sentiment for ETH shifted to bullish too

Ethereum (ETH), second only to Bitcoin (BTC) by market cap, continues its battle for dominance against BTC. Despite challenges in recent price action, ETH’s scalability remains a key driver of its growth.

At the time of writing, on the daily chart, ETH/BTC formed a Double Bottom, usually, a reversal pattern. This suggested that ETH may soon dominate the crypto markets.

Additionally, the ETH/USD chart highlighted a symmetrical triangle with a double bottom on its lower trendline, reinforcing a potential shift in market sentiment favoring Ethereum.

Source: X

These signals, together, suggest that now might be the ideal time to consider shifting focus towards Ethereum. This, in anticipation of a possible hike in its dominance. Popular analyst Michael van de Poppe also noted the same on X,

“In theory, there’s one massive bearish divergence on the Bitcoin dominance. This should be eager to break downwards, in which ETH carries the markets. I’ve not been this excited about the markets for a long time.”

Moreover, the Supertrend indicator has been holding strong too, signaling a buying opportunity. ETH’s on-balance volume (OBV) steadily increased recently, further supporting this potential shift.

Despite bearish sentiments across the market, these technical signals have been showing strength for Ethereum. Simply put, a shift towards ETH dominance could be imminent soon.

Source: TradingView

A combination of the indicators, with the overall market setup, suggested that Ethereum will lead the way for altcoin season.

ETH sentiment and interest

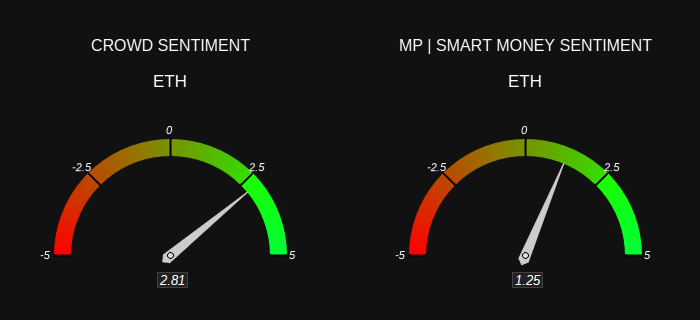

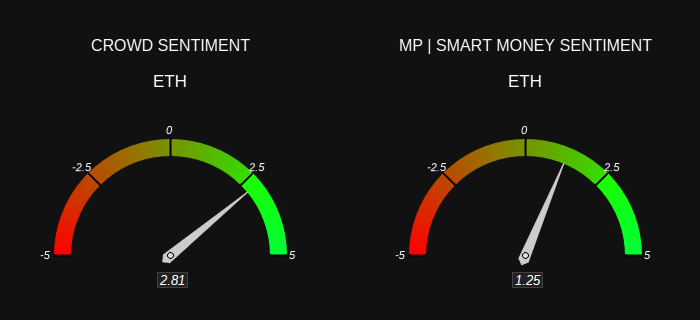

Market sentiment is also shifting now, with optimism building around ETH. The crowd is growing increasingly optimistic too, aligning with the views of Smart Money, which suggested that ETH could be set for a bullish breakout.

This shared optimism can strengthen the likelihood of ETH taking over the market, especially after a prolonged period of Bitcoin’s dominance which has rejected off the 60% level. Right now, BTC’s dominance is around the 57% level.

Source: Market Prophit

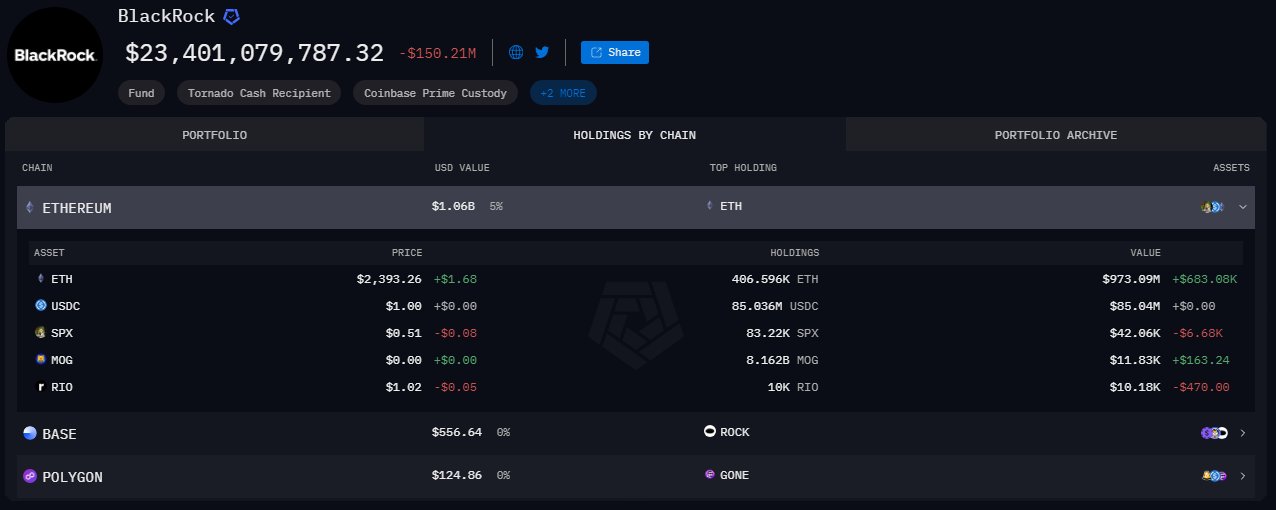

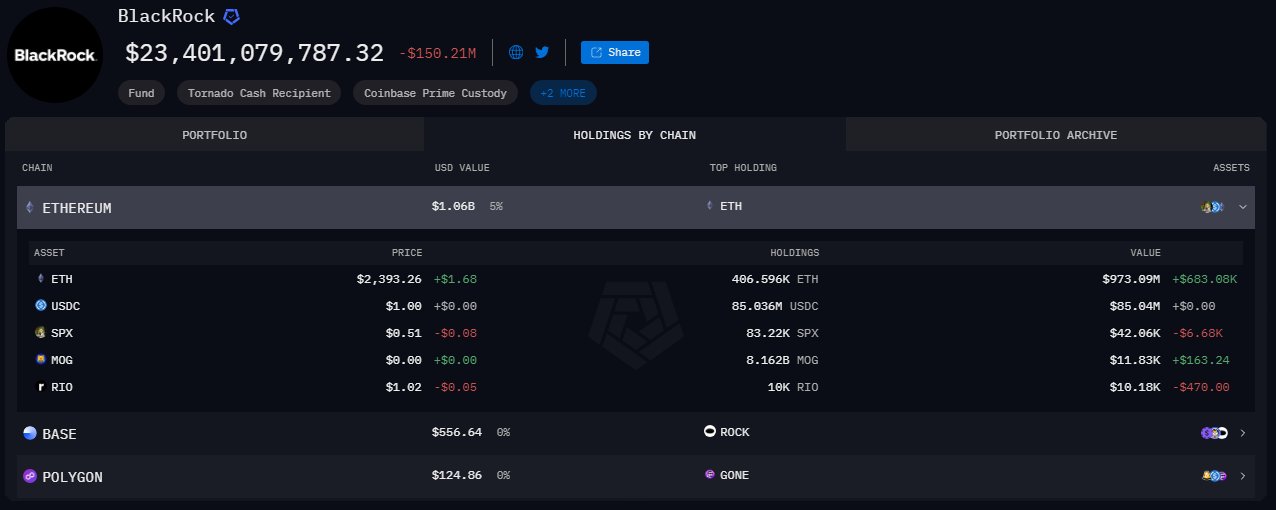

Institutional interest in Ethereum is also rising rapidly. In fact, Arkham’s data revealed that Blackrock’s ETH holdings are nearing a $1 billion valuation, underscoring significant institutional confidence in ETH.

This rapid accumulation by major financial institutions further validated the idea that a shift to Ethereum could be on the horizon.

Source: Arkham

With this level of institutional backing, combined with positive market sentiment and technical indicators, Ethereum may be poised for potential higher prices. Especially as it aims to take over market leadership from Bitcoin.