- Chainlink was down by 0.49% in the last 24 hours, as the outlook is bearish.

- Majority of LINK active holders are in the red.

Chainlink [LINK] has seen modest gains on the higher timeframes, with the price up 1.35% for the month and 0.69% for the week as at press time as per CoinMarketCap.

However, despite these gains, LINK’s current price of $10.64 reflected a slight 0.49% drop, highlighting its struggle in the broader downtrend that began after the end of the last bull run.

This downturn has continued, with periods of temporary gains but a general trend downwards in line with the rest of the crypto market.

The price action of LINK/USDT pair showed bearish sentiment, as the price consolidated within a symmetrical triangle and has already pierced the lower trendline.

If LINK breaks and holds below this trendline, it could be a clear signal of further decline. The next price target for LINK would be the $8 level, where some support and potential recovery might be found.

Source: TradingView

The MACD indicator further suggested that sellers were gaining strength as the momentum bars darkened, reflecting growing bearish pressure.

Additionally, the Stochastic RSI indicated that LINK eas oversold, a signal that sellers were dominating the market.

While oversold conditions don’t always lead to a bounce, they reinforce the likelihood of a continued drop toward $8, despite hopes for a bullish fourth quarter in the crypto space.

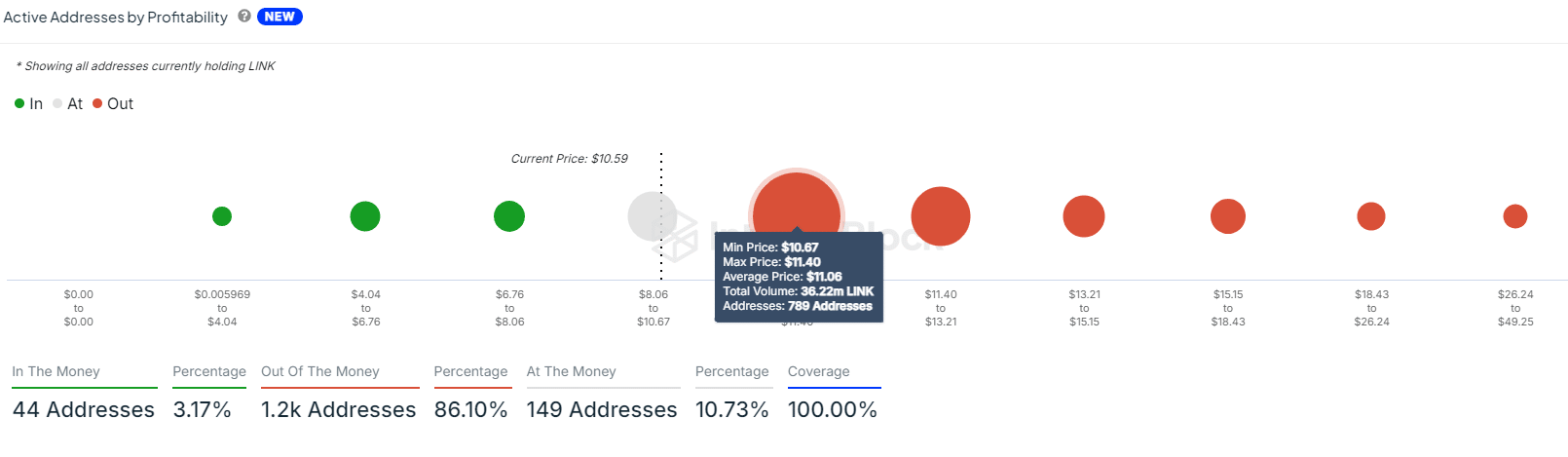

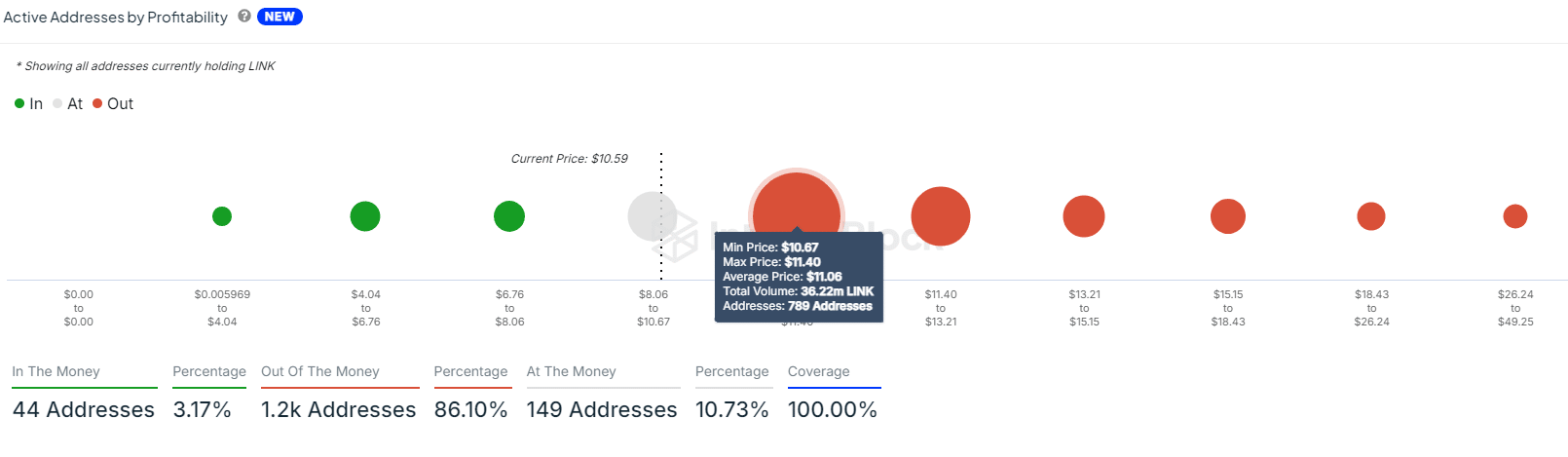

LINK’s In/Out of the Money

Examining the on-chain metrics for Chainlink revealed more reasons for concern. Approximately 86% of active addresses were “Out of the Money,” at press time, meaning most holders were facing losses.

Only 3% of active addresses are in profit, and 10% were breaking even. This negative balance created additional selling pressure, as traders may look to offload their tokens to avoid deeper losses.

Source: IntoTheBlock

With such a high percentage of addresses in the red, the outlook for LINK in the short term pointed towards further downside, making a drop to $8 increasingly likely.

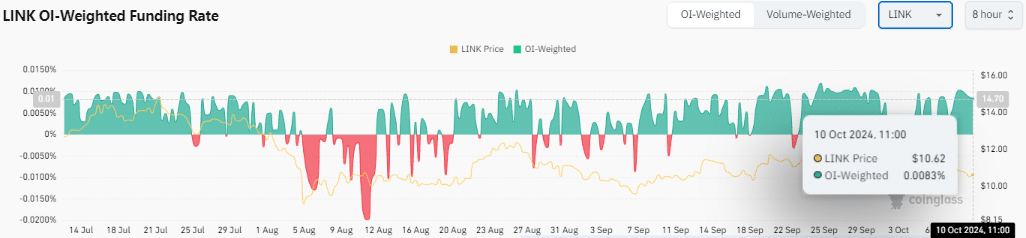

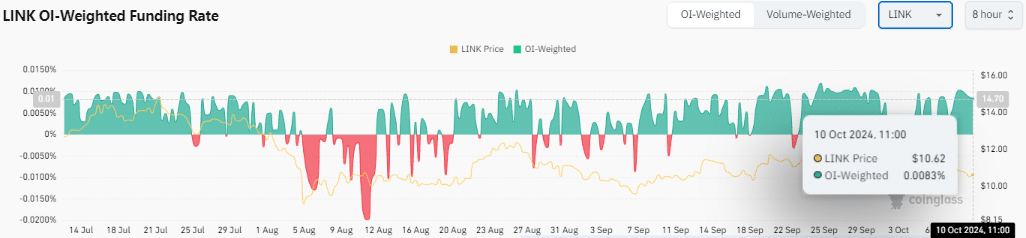

LINK OI-Weighted Funding Rate

There is, however, a glimmer of optimism in the Open Interest-Weighted Funding Rates, which were positive at 0.0083%.

Read Chainlink’s [LINK] Price Prediction 2024–2025

This indicates that long traders are paying short traders, which could signal some hope for a reversal. Still, this factor alone may not be enough to counter the broader bearish momentum in the market.

Source: Coinglass

While the long-term prospects for Chainlink remain positive, a move to $8 appears more likely in the short term before LINK can begin to recover and push higher.