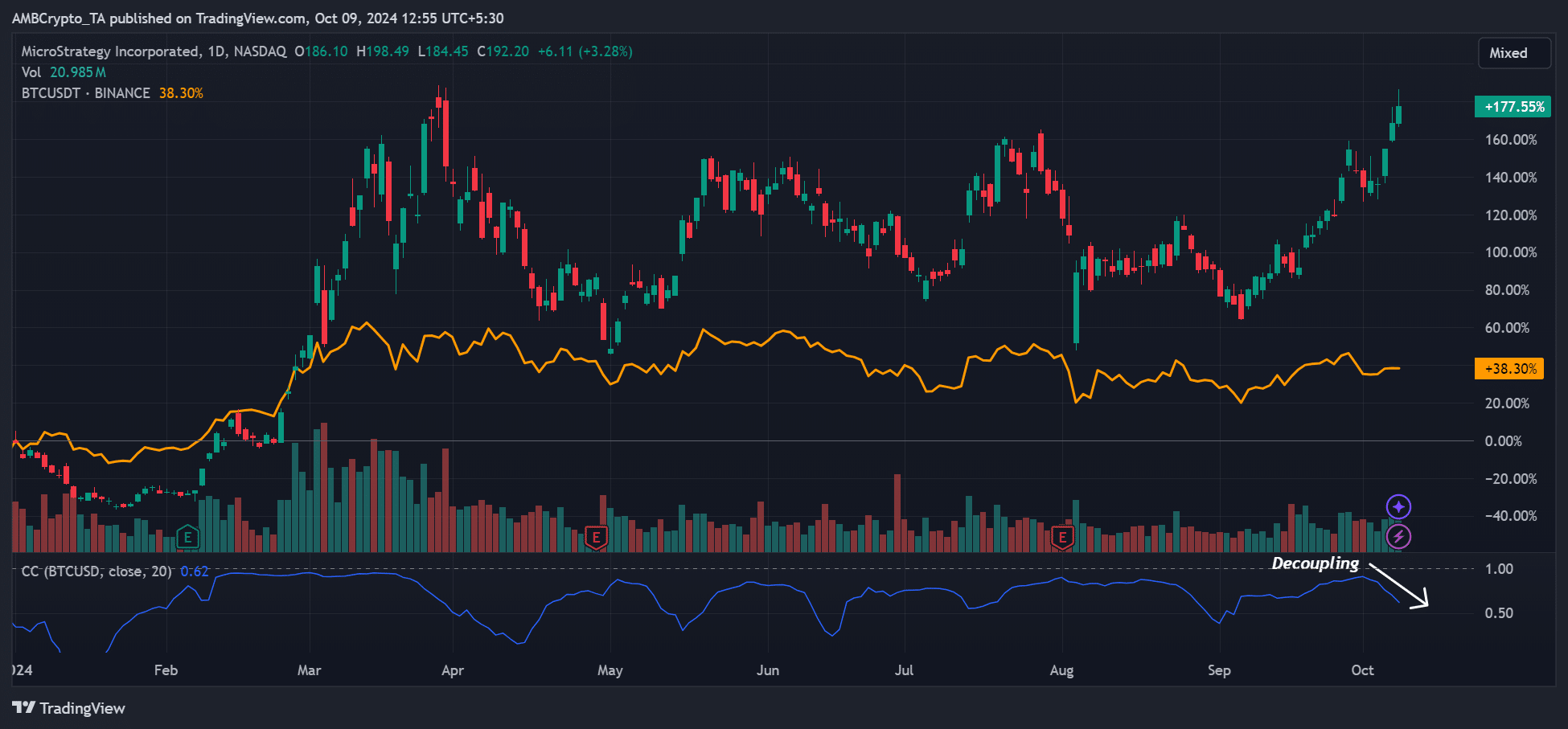

- MSTR has outperformed and decoupled from BTC.

- Since September, it hiked 68%, nearing its ATH.

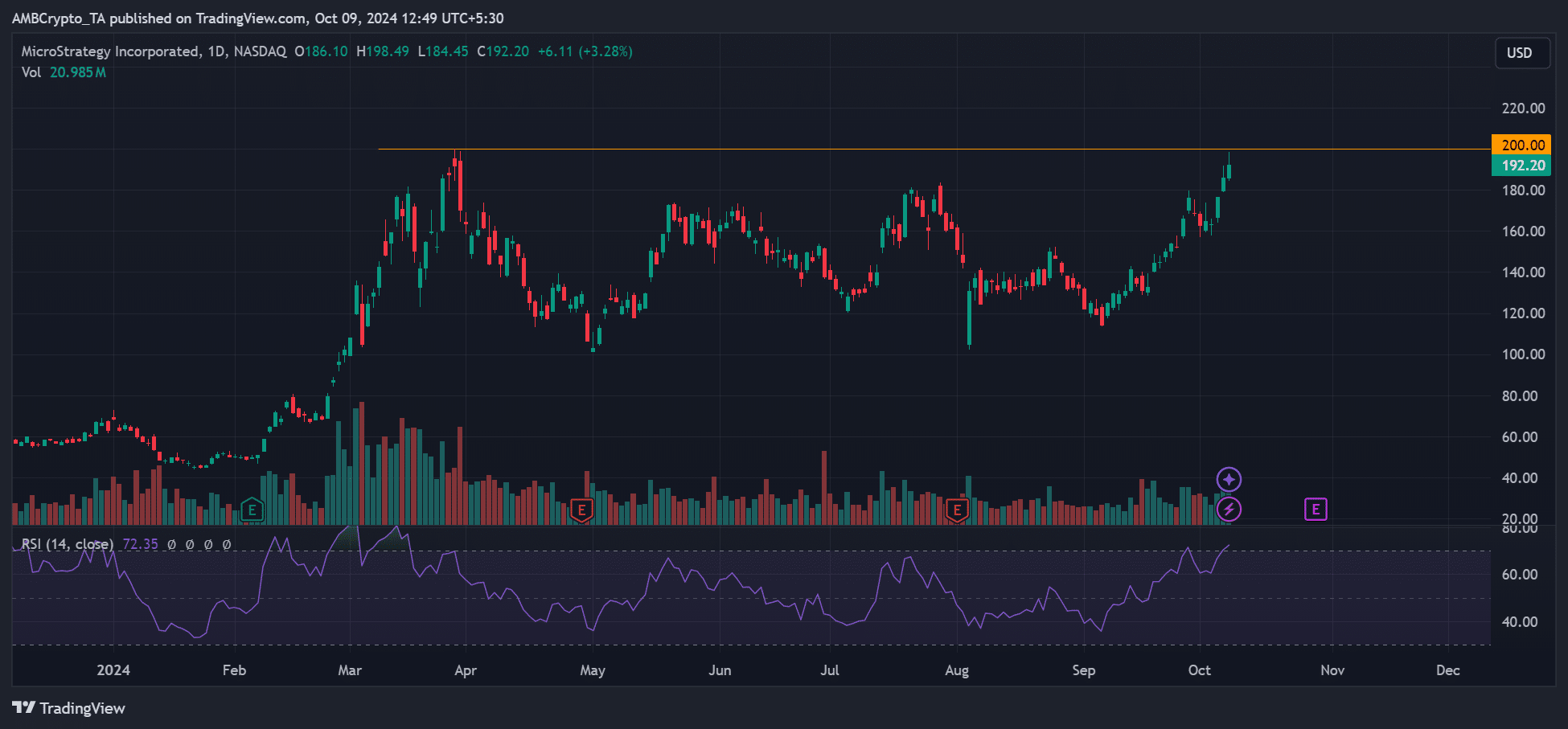

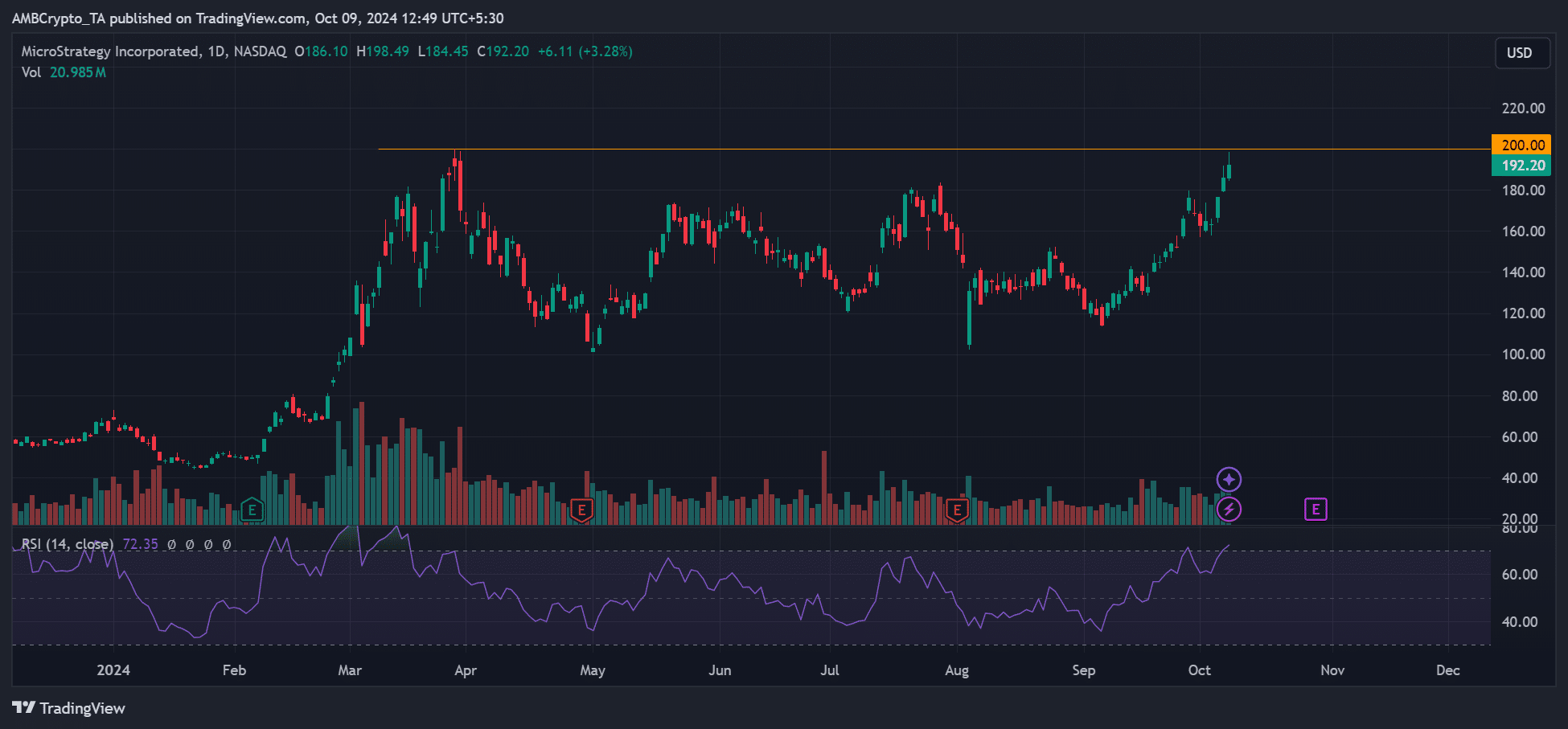

MicroStrategy [MSTR], has reached a six-month high of $198, just shy of its ATH of $200. The latest upswing coincided with the founder, Michael Syalor’s cryptic message.

In his latest X (formerly Twitter) post, Saylor wore a gladiator-like attire, a Bitcoin [BTC] pendant, and a sword.

This might be interpreted as his willingness to defend publicly and champion BTC amid fiscal instability and fiat-driven inflation.

Saylor is perhaps the most notable BTC bull who’s Uber-bullish on the asset. He believes that BTC is the most superior asset and store of value in human history, given its fixed supply and censorship resistance properties.

His stance has informed the BTC treasury strategy, which he pioneered with MicroStrategy.

The Bitcoin-focused software provider now has nearly $16 billion in BTC (252K coins), with over $1.5B acquired in Q3 2024.

$16B BTC holding triggers MSTR rally

MicroStrategy’s MSTR rally has been linked to the firm’s massive BTC hoard, as noted by CryptoQuant.

“Since MicroStrategy began purchasing $BTC on August 11, 2020, its stock has surged by 1,208%, while Bitcoin itself has risen by 445%.”

That said, MSTR’s massive BTC stash, mainly acquired through debt (convertible notes), has made it strongly correlated with the digital asset.

However, the stock’s recent rally marked a complete decoupling from BTC.

Source: MSTR vs. BTC, TradingView

Since September, MSTR has rallied 68%, hiking from $114 to nearly $200. On the contrary, BTC was up 18% over the same period and was struggling with crucial support at press time.

The rally even caught BTC critic Peter Schiff by surprise.

“What’s going on with $MSTR? It spiked 18% over the past three days, with #Bitcoin only up 1%.”

On a YTD (year-to-date) basis, MSTR was up 177%, while BTC netted 38%. This underscored that MSTR investors saw more profits than their BTC counterparts.

This also meant that MSTR was trading at a premium relative to BTC.

However, MSTR’s RSI flashed an overbought signal at press time, which might complicate the short-term outlook, especially ahead of the earning season.

Source: MSTR, TradingView

Some market observers have wondered why investors would go for MSTR to indirectly hold BTC instead of buying the asset directly. But Bitwise’s Jeff Park viewed MSTR as a simultaneous long and short global carry trade.

“$MSTR is simultaneously long & short global carry. Taking on debt at low rates to invest in Bitcoin is a long global carry. Bitcoin in and of itself is short global carry.”

For perspective, carry trade involves borrowing from low-interest currency to invest in a high-yielding asset. MicroStrategy’s BTC stash has been acquired through debt.

However, BTC is also deemed a risk-off asset and a hedge against inflation linked to fiat currencies. Hence, MicroStrategy’s move might be considered betting against global inflation—a short global carry.