- The POL migration was a key step toward the aim of Polygon 2.0.

- The on-chain metrics showed high token movement.

Polygon [MATIC] saw a technical upgrade go live on the 4th of September that saw its token become the Polygon Ecosystem Token [POL].

MATIC tokens held on the Polygon network would be upgraded 1:1 to POL, while the MATIC in Ethereum [ETH] smart contracts will need to manually interact with the migration contract to upgrade to POL.

The ultimate vision for Polygon is to unite the Web3 space, including the different blockchain networks. It aims to do that using the AggLayer, or the aggregation layer.

Polygon connecting all of the crypto space

The aggregation layer is similar to a cross-chain interoperability program. However, unlike such programs, the AggLayer won’t be ecosystem-specific. It aims to connect all L1s, and L2s, to bring them all together to unify all blockchains.

In that pursuit, the technical upgrade and migration were a key component of the Polygon crypto 2.0 aim. This would enhance security and scalability and bring zero-knowledge proof aggregation from the connected chains. This factor boosts privacy as well.

The users of different L1 blockchains suffer from fragmentation and are forced to bridge between blockchains to use them. This blockchain isolation has existed for years and means they have no way of communicating with one another.

The Polygon crypto AggLayer will, among other things, do away with the need for third-party protocols for this cross-chain interoperability issue, reducing vulnerabilities.

Effect of the technical upgrade on sentiment

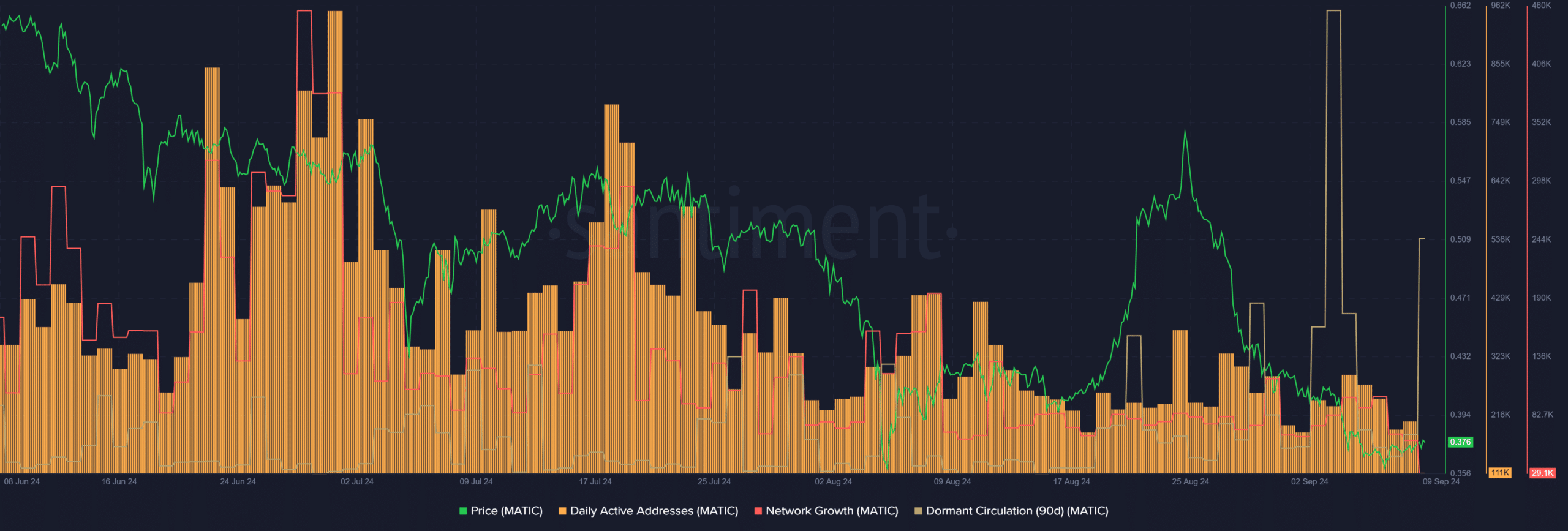

Source: Santiment

The daily active addresses metric trended downward over the past two weeks. The network growth has decreased in August compared to July but the trend of the past month was stable.

Is your portfolio green? Check the Polygon Profit Calculator

There was a large spike in dormant circulation on the 3rd of September, which usually indicates selling activity.

A price drop from $0.41 to $0.367 was seen within 24 hours of that jump. Another wave of selling was in the making.