- Per Hayes, BTC could drop below $50k despite the expected Fed rate cut.

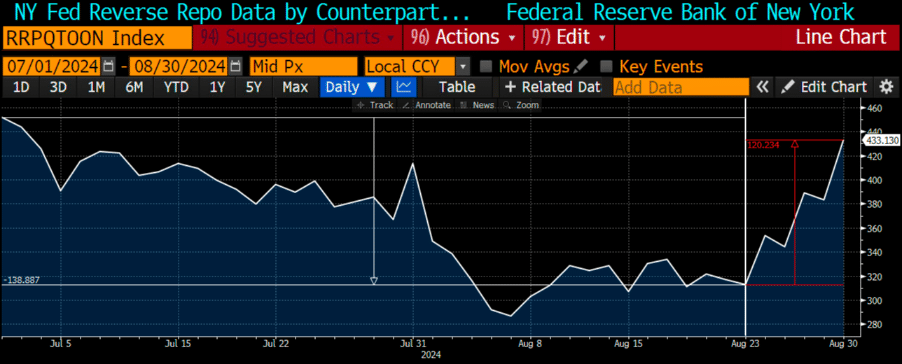

- Financial institutions are reportedly parking money into the Fed’s RRP for higher yields instead of risk assets like BTC.

In less than a week into September, Bitcoin [BTC] has shed 4%, slipping from $59.8k to barely holding above $56k at the time of writing. Market observers have widely expected the likely Fed rate cuts in September to be a potential catalyst for BTC and the risk market.

However, according to BitMEX founder Arthur Hayes, the short-term weakness could persist even after the Fed rate cuts expected on 18th September.

Per Hayes, BTC could chop or drop towards $50K as financial institutions direct liquidity to the Fed’s RRP (Reverse repurchase agreement) for higher yields. Part of his latest analysis report read,

‘As such, RRP balances should continue to rise, and Bitcoin, at best, will chop around these levels and, at worst, slowly leak lower towards $50,000.’

Source: Bloomberg

RRP is a key Fed monetary policy tool, especially in controlling money supply (liquidity) and short-term interest rates. A sharp rise in RRP would limit US liquidity and vice versa.

Macro uncertainty for BTC?

Initially, Hayes had projected that the US could increase treasury bills (T-bill) issuance, worth over $300 billion, injecting the needed liquidity and boosting BTC. However, he recently noted a hike in RRP compared to T-bill issuance, which is a net negative for US liquidity.

‘Assuming the Fed doesn’t cut rates before the September meeting, I expect T-bill yields to stay firmly below those of the RRP.’

For context, BTC has been positively correlated with US liquidity. As such, the aforementioned liquidity crunch might be bad news for the digital asset in the short term.

However, the executive noted that his bearish BTC outlook was temporary, and the weakness would be a buying opportunity.

‘My shift in opinion keeps my hand hovering over the Buy button. I am not selling crypto because I am short-term bearish.’

Besides this likely caveat on the macro front, BTC has historically posted weak September results. However, as noted by QCP Capital, the crypto might see strong relief in October.

‘October, however, has the strongest bullish seasonality, with BTC showing positive returns and an average gain of 22.9% in 8 out of the last 9 Octobers.’

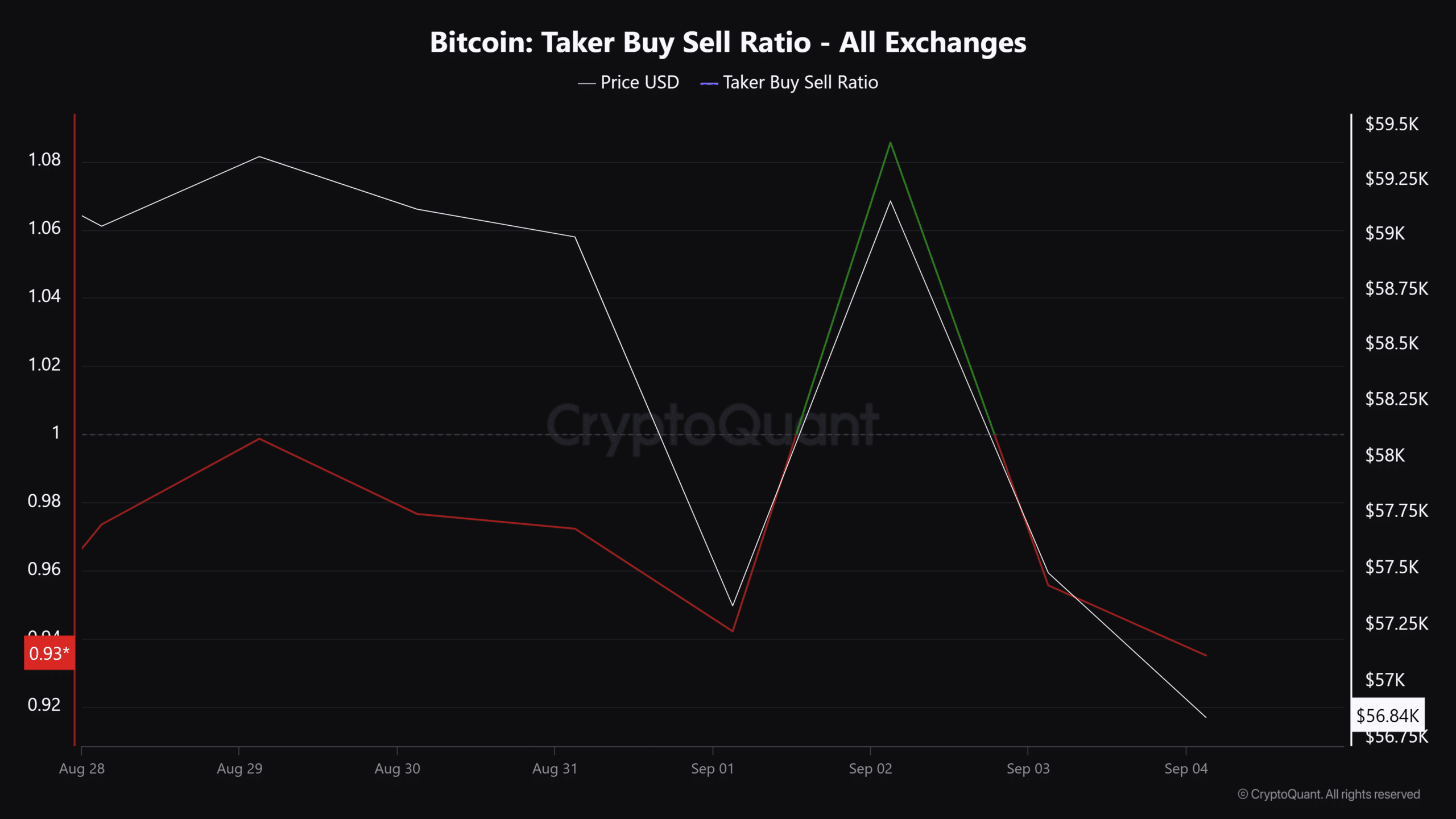

In the meantime, the crypto Fear and Greed index reading was at 27 and flashed ‘fear’ at press time. The derivatives segment was also overwhelmingly bearish, as shown by the negative Taker Buy Sell Ratio.

The reading meant seller volume dominated buyers, illustrating that weak sentiment prevailed.

Source: CryptoQuant