- Cardano completed its upgrade on the first day of the month.

- ADA’s reaction has been rather stifled as it remained below its moving averages.

The long-awaited Cardano [ADA] hard fork has finally been implemented after some technical delays necessitated rescheduling the update.

This upgrade has introduced changes to the network’s setup, marking a significant milestone for the blockchain’s infrastructure.

However, despite these advancements, the situation for ADA remains challenging as more crypto whales have begun to free up their holdings.

Crypto whales dump ADA

The recent Chang hard fork, which was anticipated to enhance the network’s functionality, has yet to result in ADA’s positive movement. Instead, there has been a notable trend of crypto whales reducing their ADA holdings.

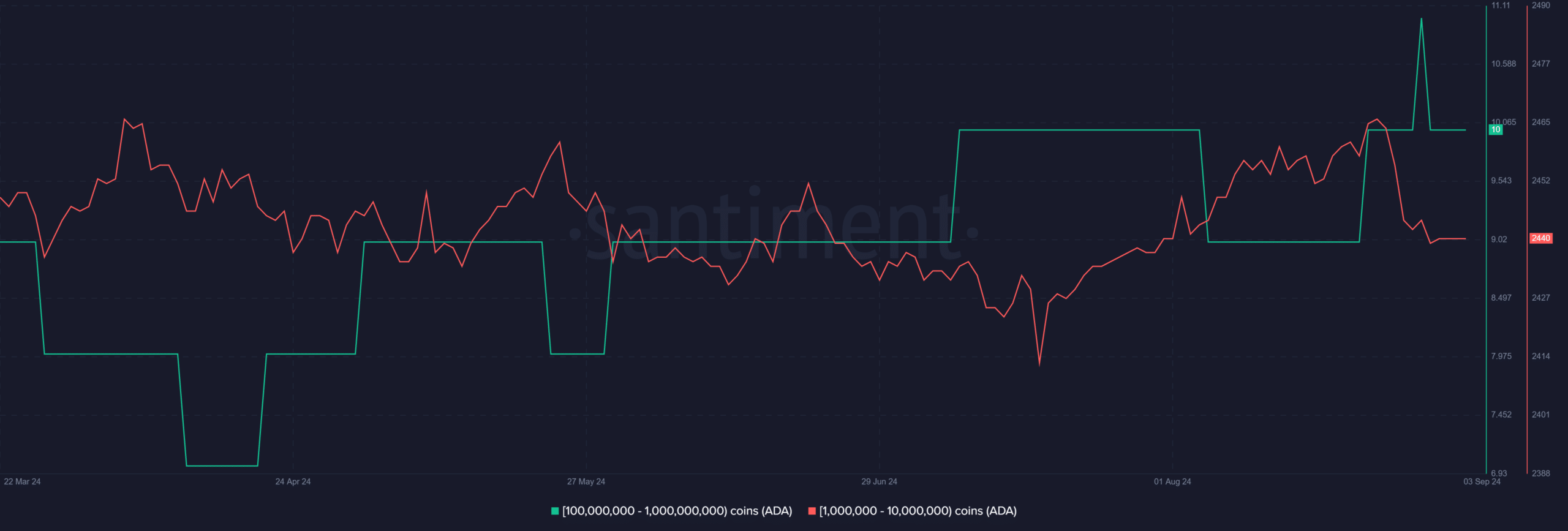

Data from Santiment indicates that these whale addresses, particularly those holding between 1 million and 1 billion ADA tokens, have recently decreased their positions.

This reduction suggested that these addresses sold off a substantial portion of their holdings as the upgrade approached.

Source: Santiment

Further analysis revealed that these whale addresses collectively offloaded over $326 million worth of ADA, representing about 15% of their total holdings.

This sizable sell-off highlighted a potential lack of confidence among major investors in ADA’s near-term price prospects despite the technical advancements brought by the hard fork.

The behavior of these whales is a critical indicator of market sentiment, as their actions often reflect broader concerns or expectations.

The decision to dump such a significant amount of ADA before or shortly after the upgrade could imply that these investors are either uncertain about the immediate benefits of the hard fork or are taking a cautious approach due to broader market conditions.

Cardano is still stuck in a bear trend

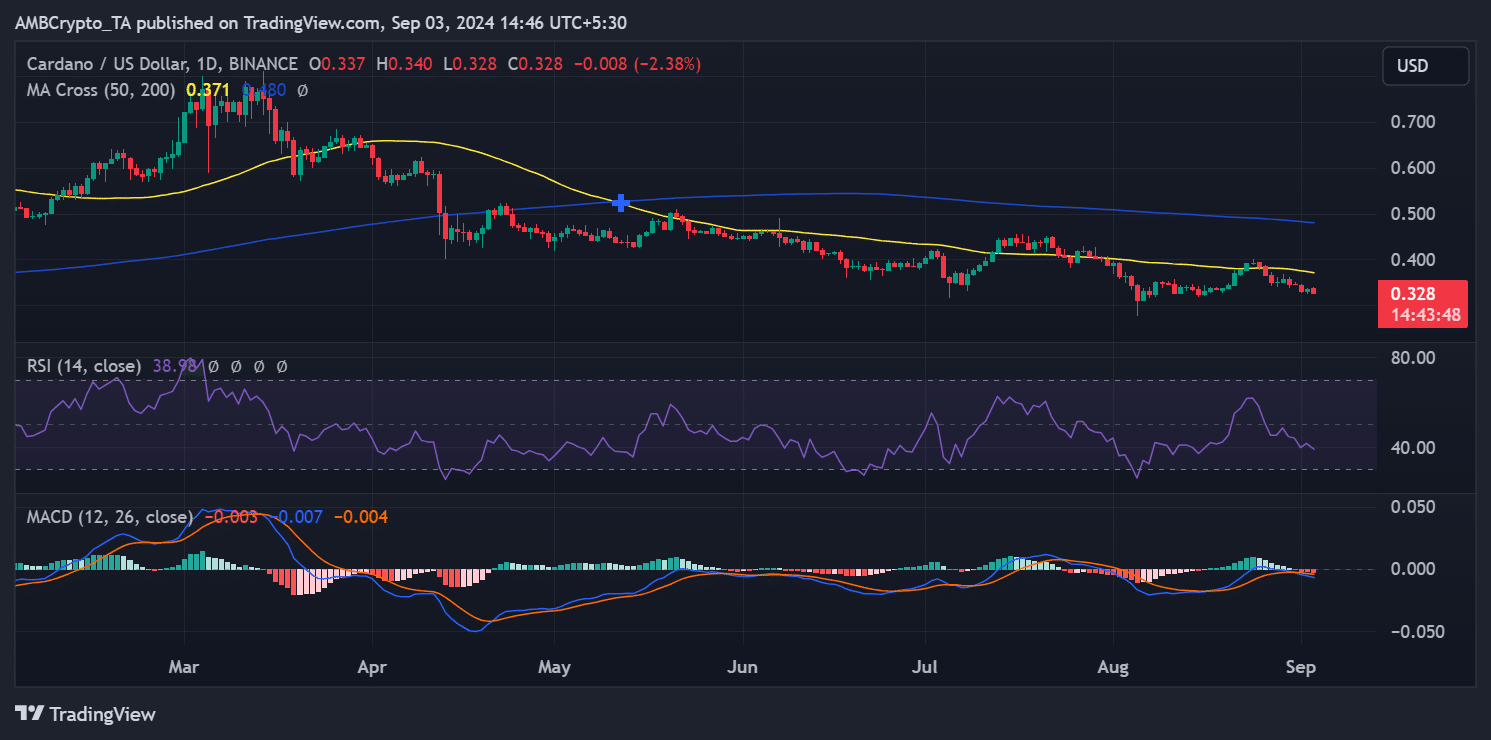

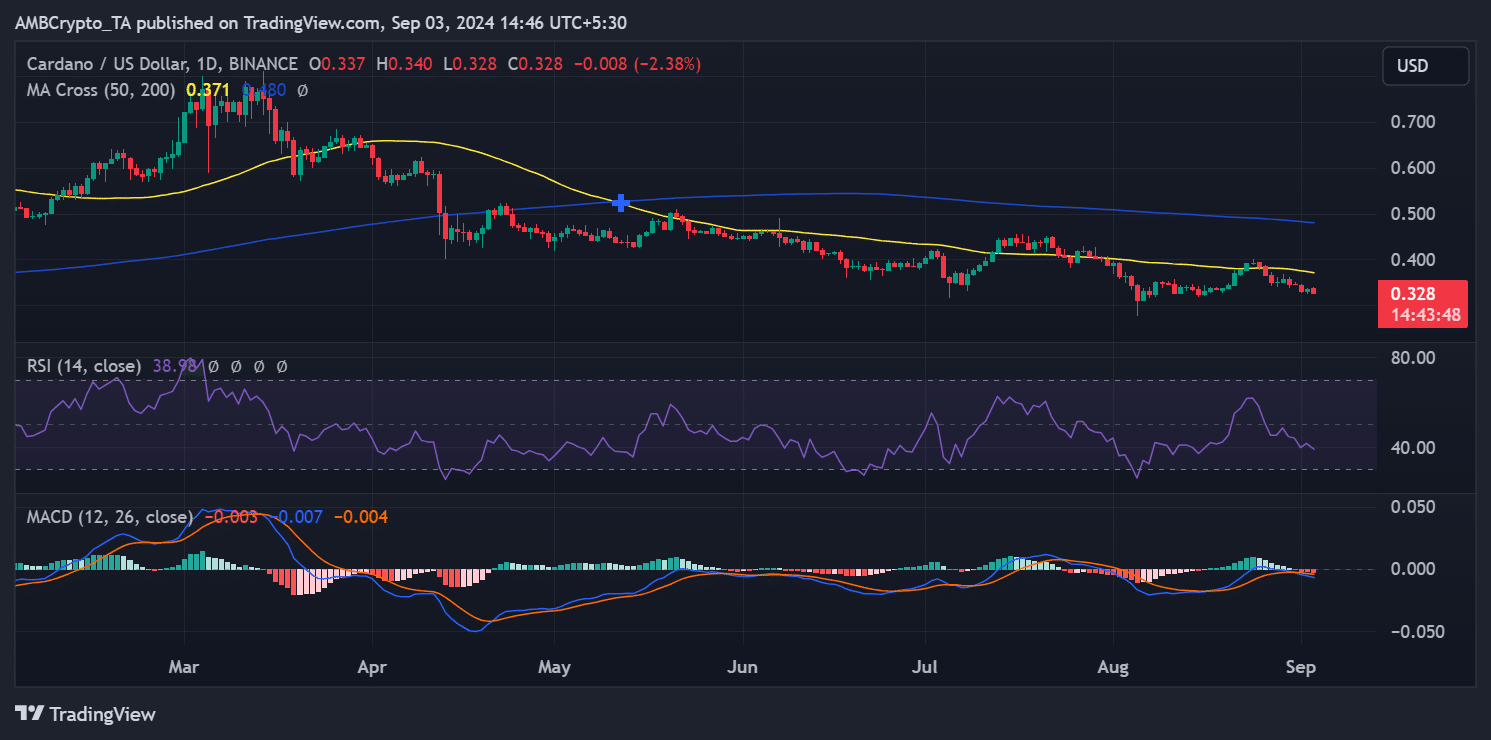

AMBCrypto’s analysis of ADA on the daily price chart revealed a notable shift in momentum leading up to and following the recent network upgrade.

Initially, ADA experienced a positive buildup, reaching a peak on the 24th of August, when it successfully broke through a key resistance level.

However, as the upgrade approached, this upward momentum reversed, and ADA began to decline.

Source: TradingView

The price fell below its short-term moving average (yellow line), which had previously served as a support level but now acts as resistance.

As of this writing, ADA was trading at around $0.32, reflecting a decline of over 2%. The modest over 1% gain it achieved in the previous trading session has been erased by this latest downturn.

Further analysis of ADA’s Relative Strength Index (RSI) suggested continued bearish momentum. The RSI was almost below the 40 level as of this writing.

If the RSI dips below 40, it could indicate that ADA is entering the oversold zone. The level is often associated with increased selling pressure and further declines.

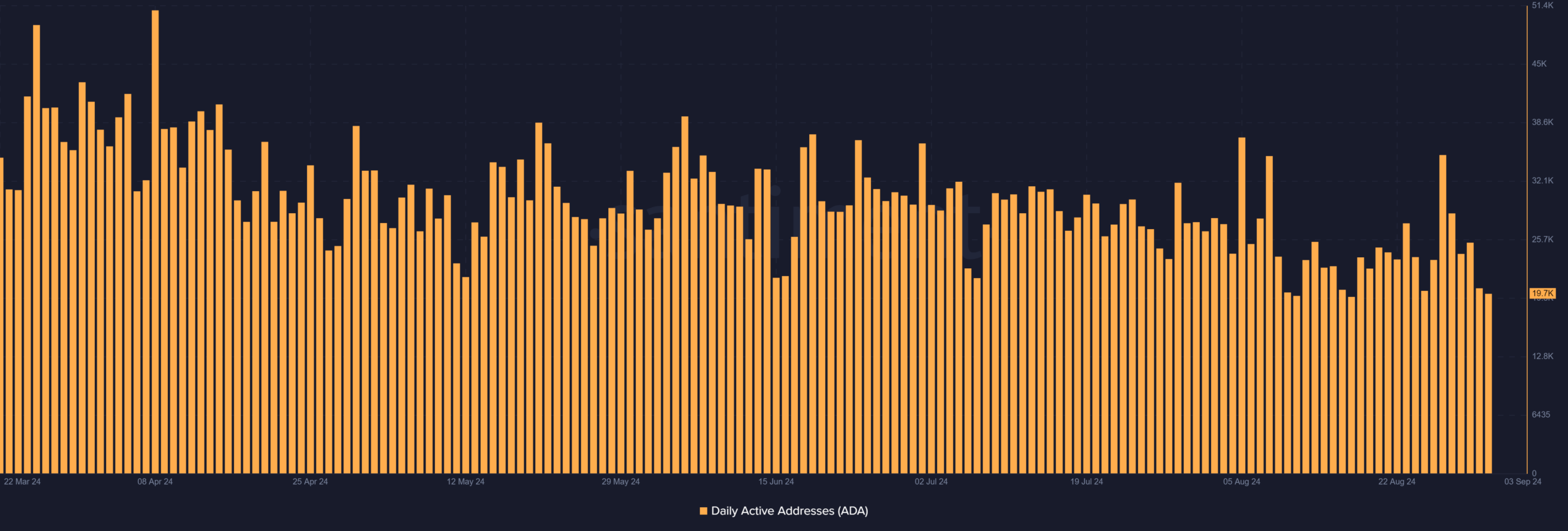

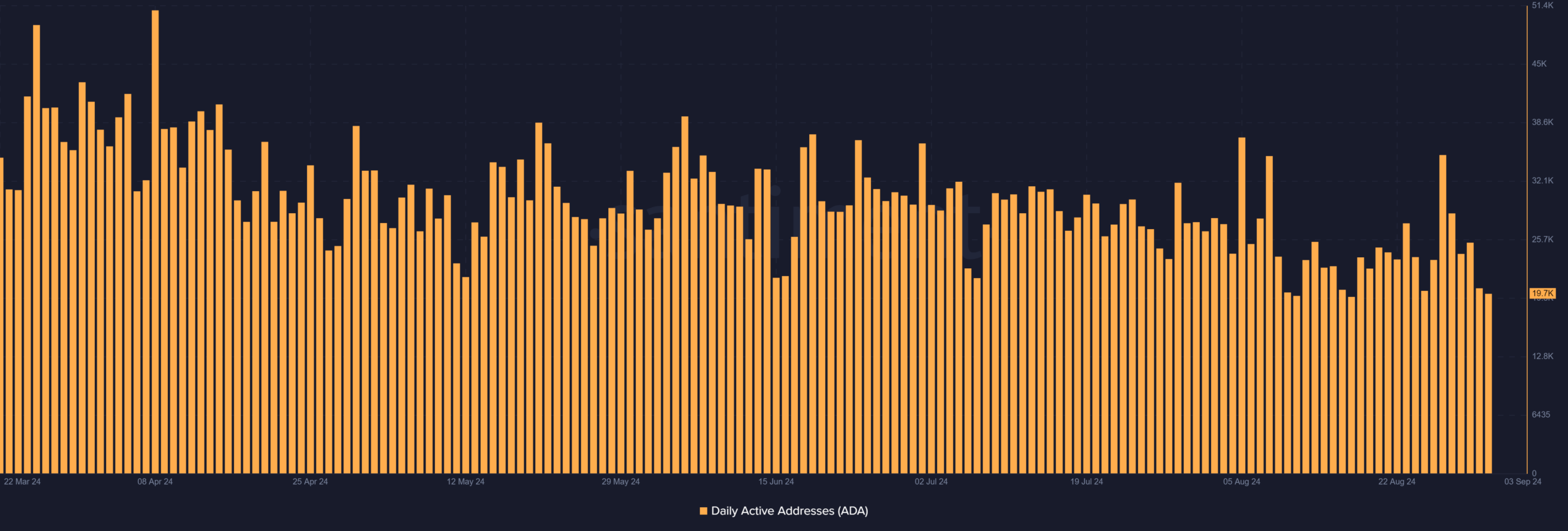

Fewer addresses become active

The recent analysis of Cardano’s daily active addresses revealed a significant decline in network activity over the past seven days.

Data from Santiment shows that the number of active addresses spiked around the 27th of August, reaching over 35,000. The spike is likely due to increased interest leading up to the network upgrade.

However, this activity level rapidly decreased in the days that followed.

Source: Santiment

Is your portfolio green? Check out the ADA Profit Calculator

As of this writing, the number of daily active addresses has dropped to approximately 19,700. This sharp decline in active addresses highlighted a noticeable reduction in network participation.

It confirmed that Cardano’s crypto whales and other holders have become less active during this period.