- Bitcoin breaks $60K, with bullish momentum suggesting a potential rise toward $70K.

- El Salvador continues daily Bitcoin purchases, boosting its total holdings to 5,851 BTC.

After days of struggling to break the $60,000 barrier, Bitcoin [BTC] is now trading above this key level. According to the latest data from CoinMarketCap, BTC is currently priced at $63,762, reflecting a slight drop of 0.32% in the past 24 hours.

Saylor’s Bitcoin optimism

As always, Bitcoin enthusiast and MicroStrategy co-founder Michael Saylor has affirmed the cryptocurrency’s potential, commenting on its ongoing promise and growth.

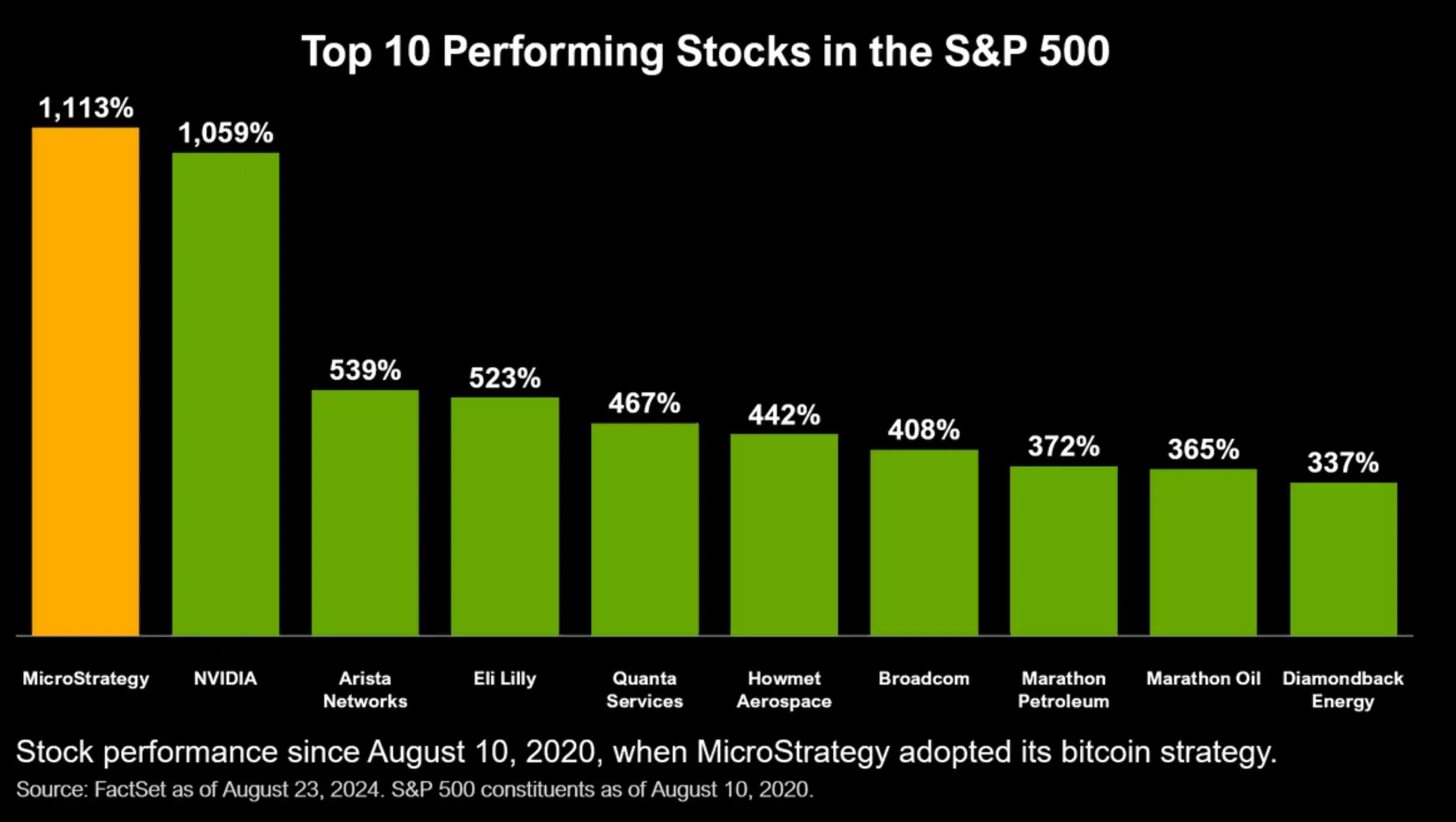

“Four years on the #Bitcoin Standard, and you would have outperformed every company in the S&P 500.”

Despite short-term fluctuations, MicroStrategy’s commitment to Bitcoin has paid off, with BTC’s returns outperforming every S&P 500 company, underscoring its superior investment growth.

Source: Michael Saylor/X

What are the metrics saying?

To gauge Bitcoin’s future trajectory, AMBCrypto analyzed TradingView data and found that the Relative Strength Index (RSI) remains bullish, positioned above the neutral level at 57.

This indicates ongoing positive momentum. Additionally, the MACD line lying above the signal line, displaying green histograms, further reinforced the notion that buying pressure is currently outweighing selling pressure.

Source: Trading View

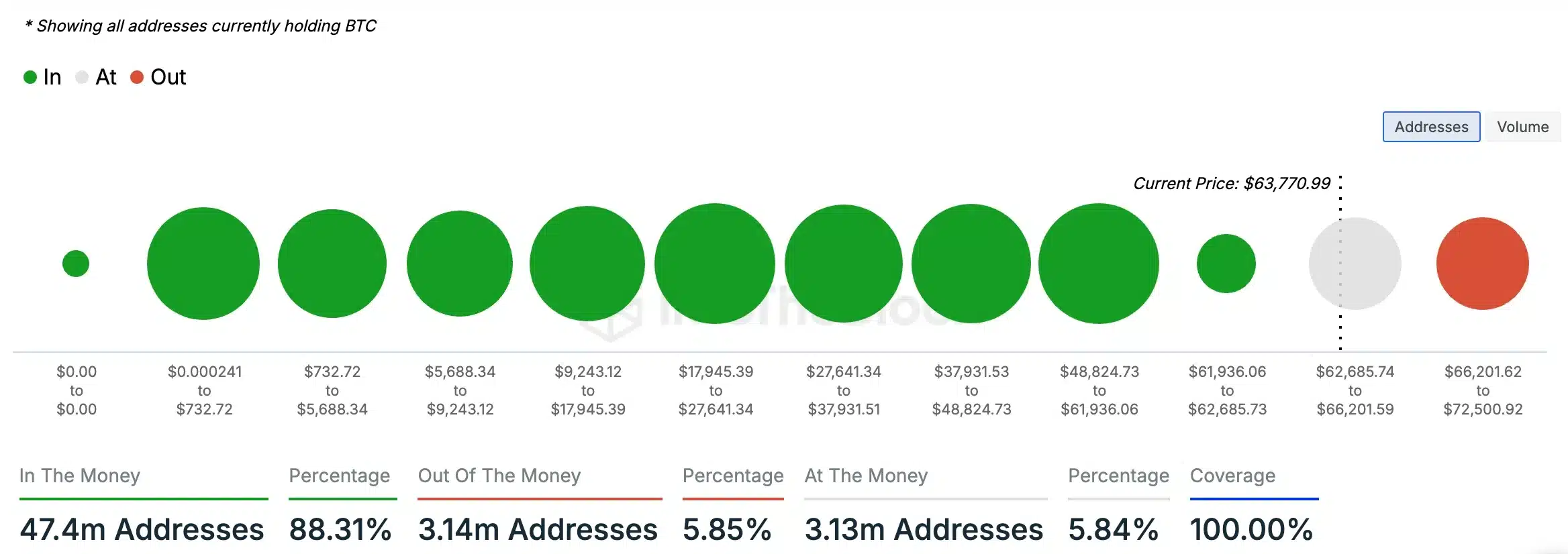

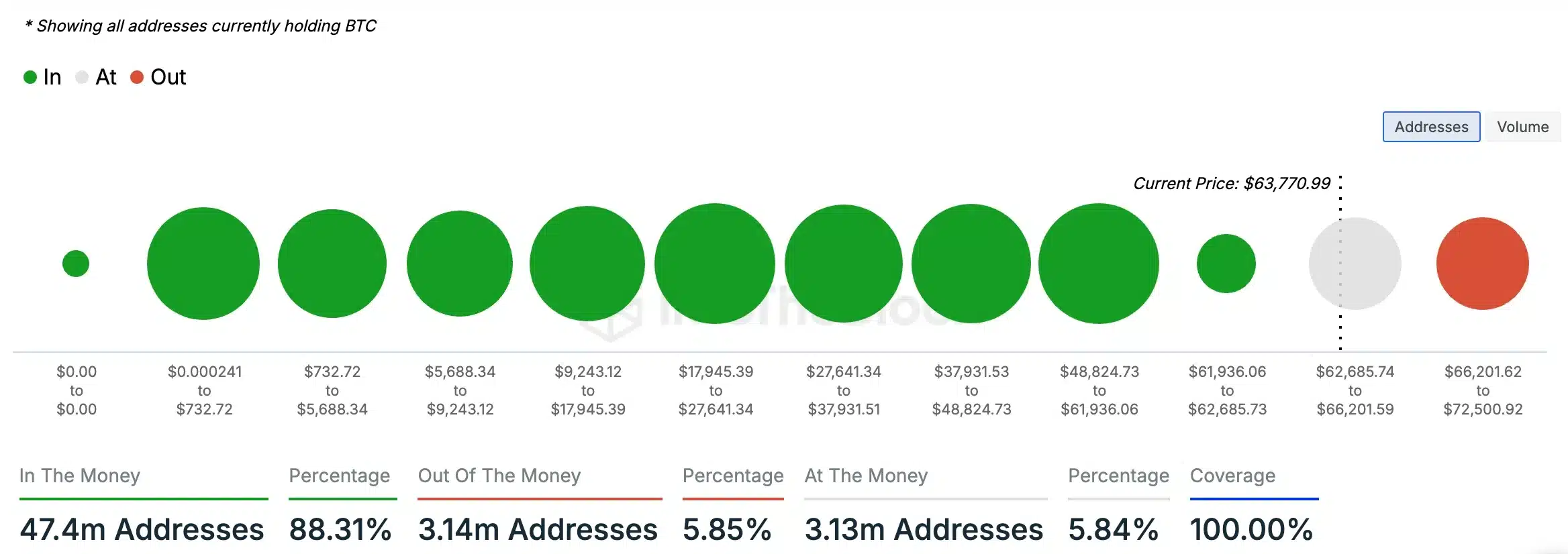

As expected the IntoThebBloack data revealed a substantial majority of BTC holders (88.31%) currently possess tokens valued above their purchase price, indicating they are “in the money.”

Conversely, only a small fraction (5.85%) hold BTC at a value lower than their purchase price, putting them “out of the money.”

This suggested that Bitcoin might be gearing up for a bull run in the coming days.

Source: IntoTheBlock

Bitcoin’s future outlook

In fact, Cathie Wood’s Ark Invest predicts that if BTC continues on this trajectory, its value could skyrocket to $1.5 million by 2030.

Adding to the fray were Jan Happel and Yann Allemann, founders of Glassnode, who confirmed that Bitcoin is well-positioned to potentially reach and test the $70,000 level again.

They caution that traders who are betting against BTC (by shorting it) when it’s around $68,000 or $69,000 could face significant losses if Bitcoin’s price continues to rise and hits $70,000, leading to forced liquidation of their positions.

Source: Negentropic/X

Additionally, El Salvador, the first country to officially adopt BTC as legal tender, has been consistently increasing its Bitcoin reserves.

Since 16 March, the Salvadoran government has been purchasing one Bitcoin daily, resulting in an additional 162 BTC added to their holdings.

As of now, El Salvador’s total BTC holdings amount to 5,851 BTC. This is valued at approximately $356.4 million based on current market prices.

Hence, as Bitcoin approaches new highs, all eyes are on whether it will break through the $66K resistance.