- Dogecoin bulls enforced a bullish market structure break.

- The lower timeframe sentiment could propel DOGE toward the nearby Fibonacci levels.

Dogecoin [DOGE] saw a positive performance in the crypto markets recently. Its 7.3% surge on Friday, the 23rd of August, was a sign of bullish intent and meant another 8%-18% move could arrive soon.

An increasing number of Dogecoin wallets were in the money. Since the market trend has been bearish since May, it indicated that profit-taking activity could rear its head and impede Dogecoin’s progress.

Dogecoin reclaims the local resistance zone as support

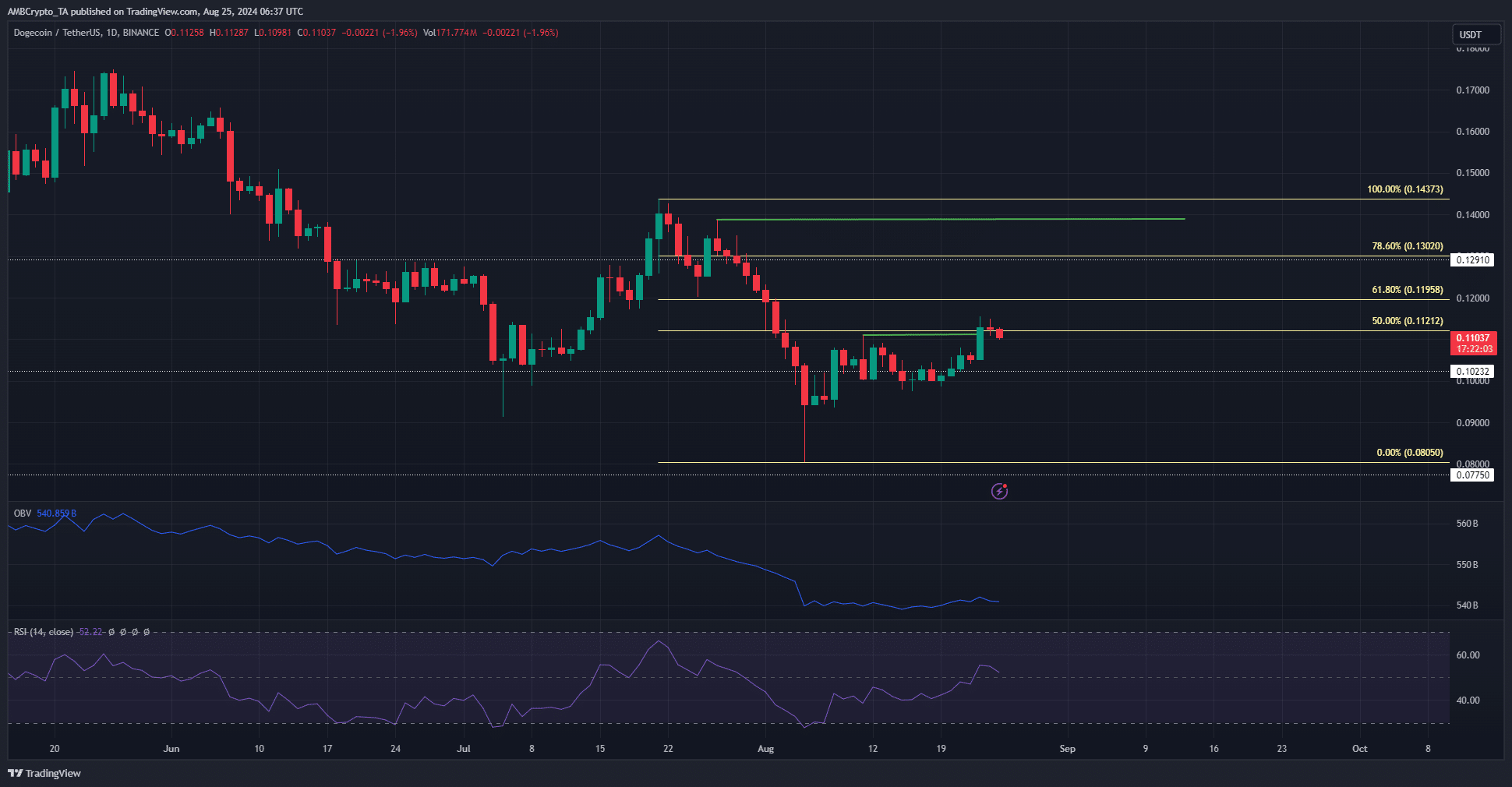

Source: DOGE/USDT on TradingView

The market structure on the daily chart was bullish after the daily session close above $0.111 on the 23rd of August. However, the longer-term trend was bearish, with occasional bullish structures in between like the recent development.

The Fibonacci retracement levels based on the past month’s price drop highlighted the $0.1196 and $0.13 levels as the next resistance zones. Given the bullish structure, Dogecoin is likely to reach one or both of these levels.

The daily RSI was above neutral 50 to signal bullishness. However, the OBV could not move higher significantly. Hence, while momentum was shifting, the lack of demand meant DOGE gains would be easy to reverse.

Short-term bullish, long-term not so hopeful

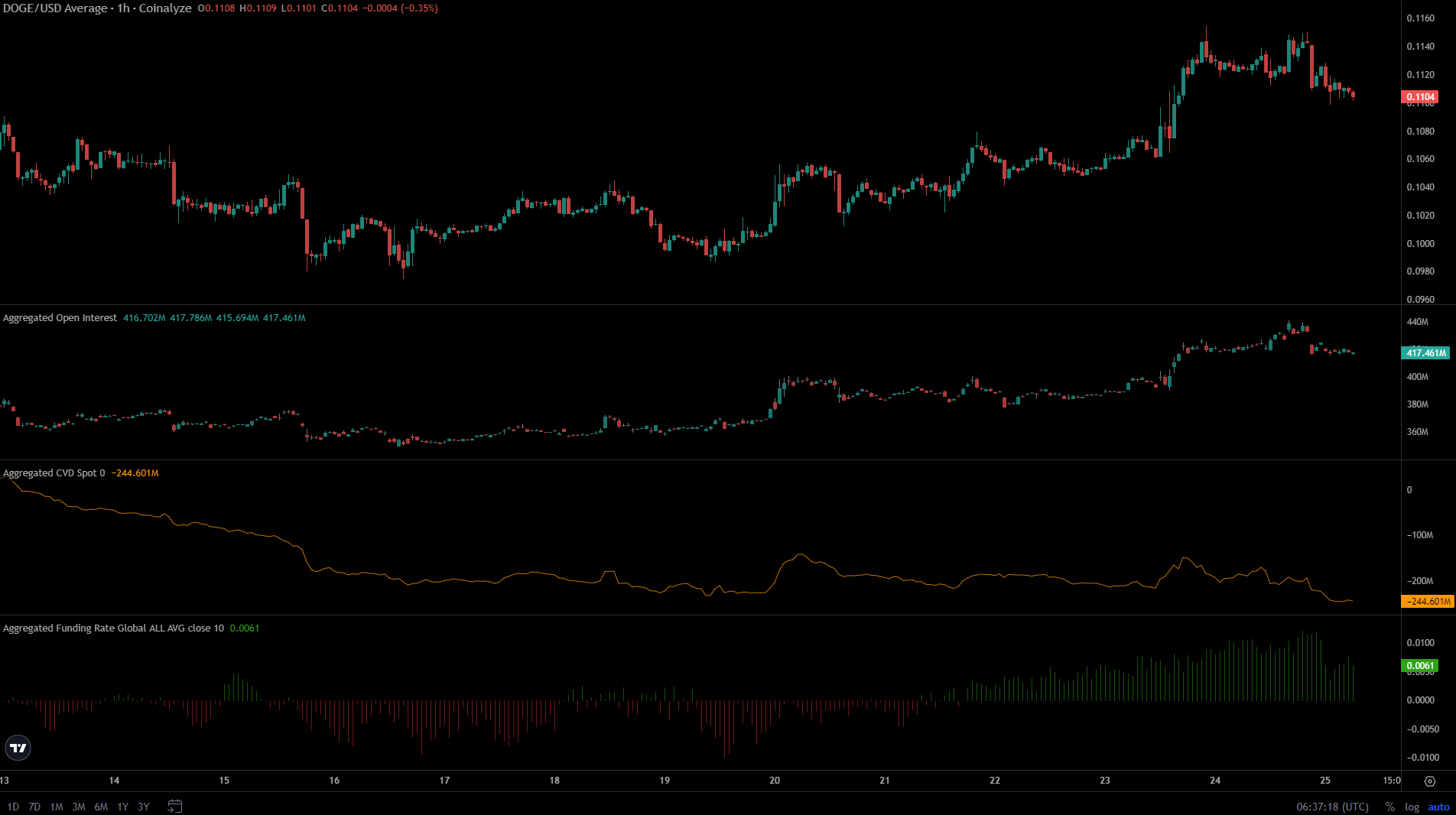

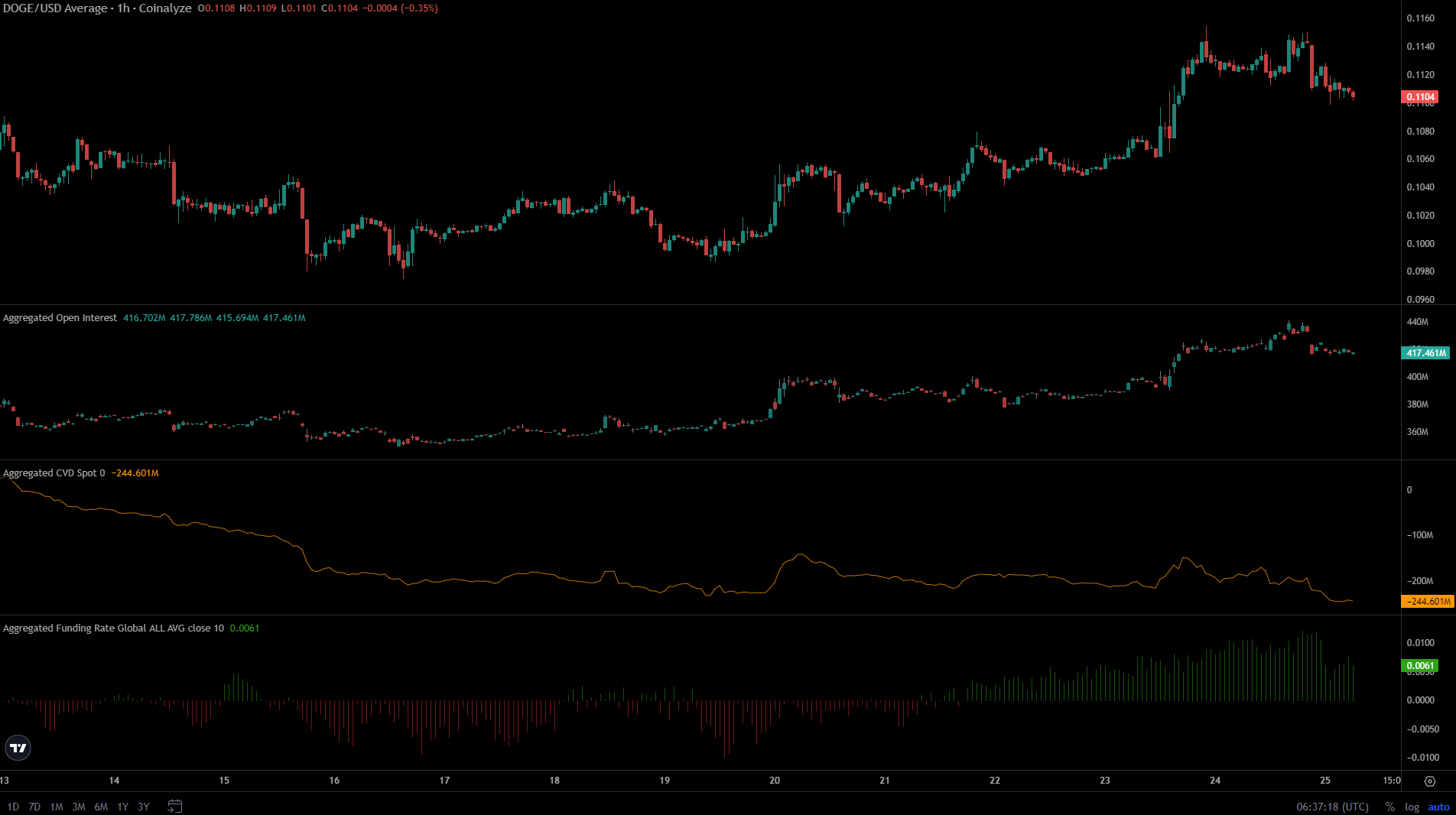

Source: Coinalyze

The funding rate behind DOGE saw a drop over the past couple of days but remained positive. The Open Interest rose alongside the price to signal bullish momentum, although it saw a minor dip in the past 24 hours.

During this time Dogecoin fell just over 4% from $0.1149 to $0.11.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

While the futures data showed speculators willing to go long, the spot CVD began to trend downward again.

It showed weak buying activity in the spot markets and reinforced the idea that Dogecoin gains could be easy to erase if bearish sentiment seized control.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion