- Notcoin’s buying pressure was not enough to force a bullish breakout.

- The Open Interest surge signaled bullishness, but the market sentiment quickly reversed.

Notcoin [NOT] climbed to the $0.01288 level on the 14th of August, but could not clear the resistance zone that extended up to $0.013. This meant the bearish market structure of NOT on the 1-day chart remained.

A recent report noted that the token’s momentum was neutral, and the market was not trending strongly. The recent rejection meant the Notcoin price prediction was bearish.

A momentum shift did not occur yet

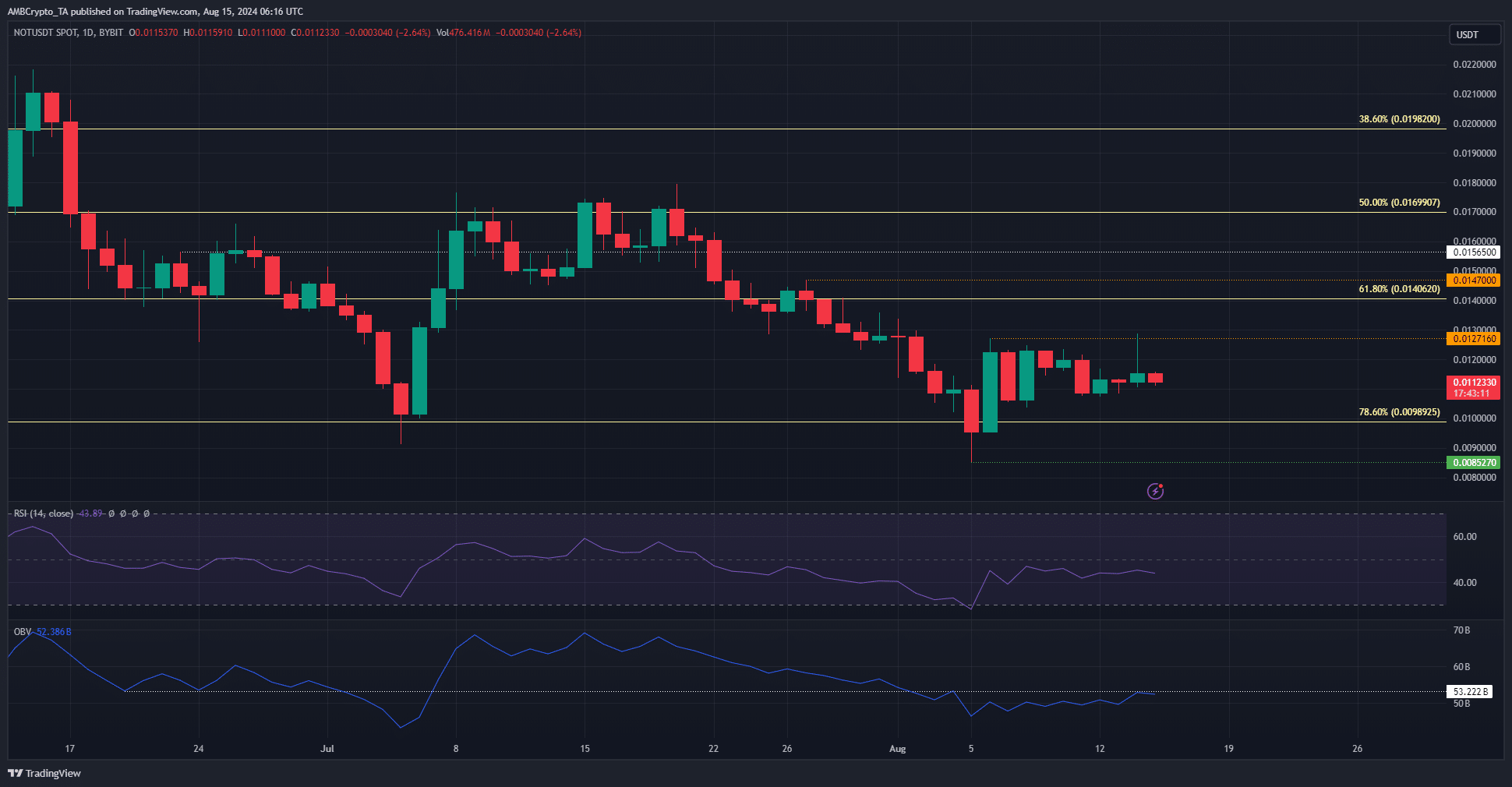

Source: NOT/USDT on TradingView

The dotted orange lines at $0.0147 and $0.0127 marked the two recent lower highs NOT formed on the daily chart.

The recent price bounce to $0.01288 did not break the bearish structure, since the trading session did not close above $0.0127.

Additionally, the RSI was below neutral 50 and the OBV was unable to break the early August highs. This was a sign of muted momentum and a lack of buying pressure.

Unless the structure flips bullishly soon, it is expected that the local lows at $0.00852 will be retested. This might pave the way for a bullish recovery.

Renewed sell pressure turns Notcoin price prediction bearish

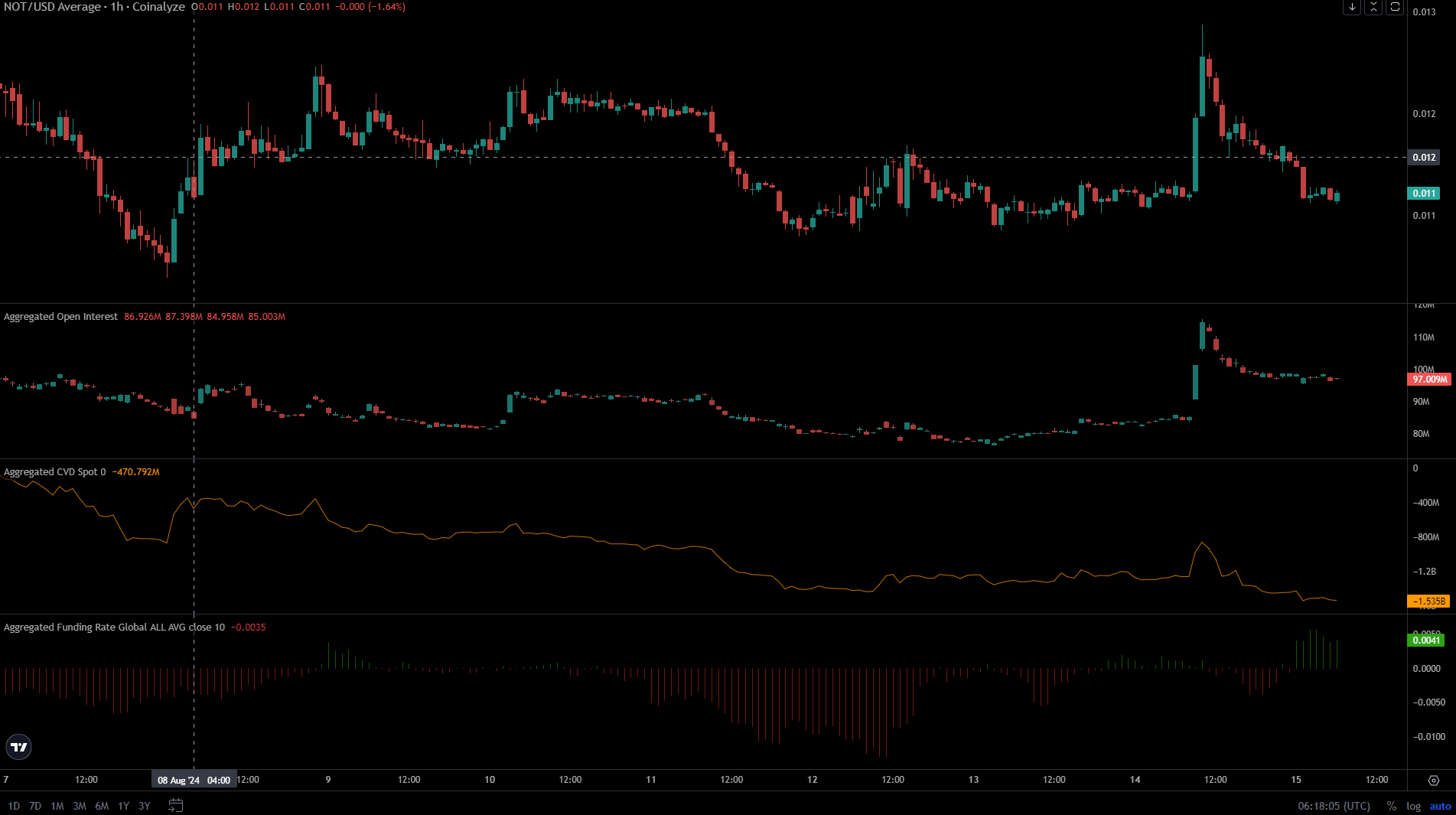

Source: Coinalyze

When NOT prices spiked on the 14th of August, the Open Interest rose from $84 million to $115 million. This surge showed bullish short-term conviction and speculators betting on continued gains.

Read Notcoin’s [NOT] Price Prediction 2024-25

The spot CVD also briefly climbed higher.

This did not last long, and a few hours later the OI and the spot CVD began to slump, showing seller dominance. The Funding Rate remained positive, but a move southward appeared likely.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion