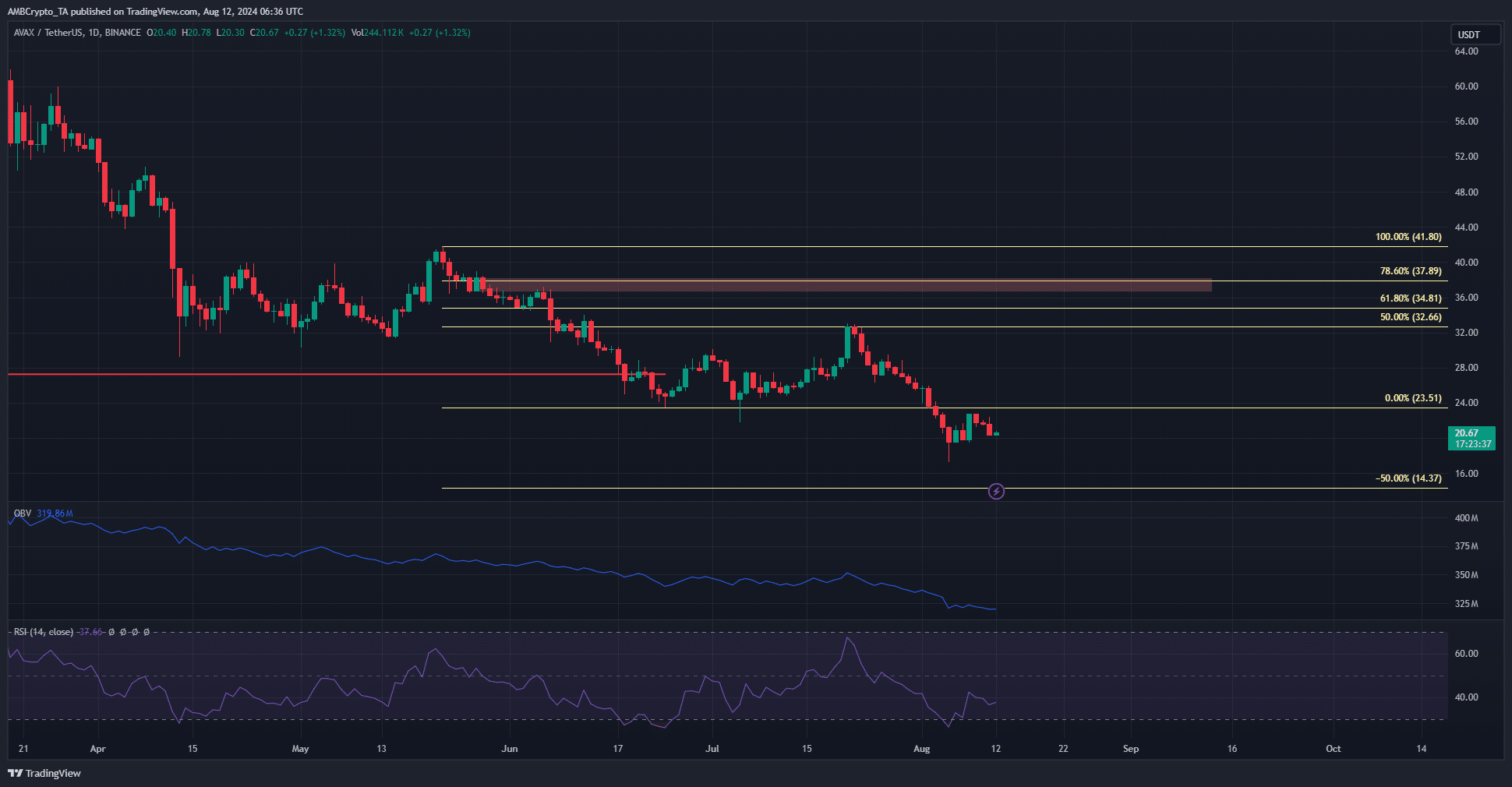

- The former support zone at $23.5 served as resistance during the recent bounce.

- The strength of the sellers was too high and the downtrend is expected to continue this week.

Avalanche [AVAX] was nearing the $19.6 short-term support level. Its trend remained bearish on the 1-day chart. With Bitcoin [BTC] below $60k, sentiment in the crypto market appeared weak.

This could see Avalanche plunge further. The futures market of AVAX was not bullish either. What are the price targets in case of a drop?

Avalanche retests former support zone as resistance

Source: AVAX/USDT on TradingView

From mid-June to early August, the $23.5 level was a support. It was breached during the intense selling pressure and was retested over the past few days as resistance. An AVAX bounce to the $22.8 level was met with rejection.

The daily RSI was still below neutral 50 and the OBV continued to trend downward. Together they were a sign of strong bearish momentum and a lack of demand.

The $19.2 and $14.37 levels are the next targets, based on recent price action and the Fibonacci extension levels. The trajectory of Bitcoin could heavily influence AVAX, and sentiment was turning bearish since BTC was below $60k once more.

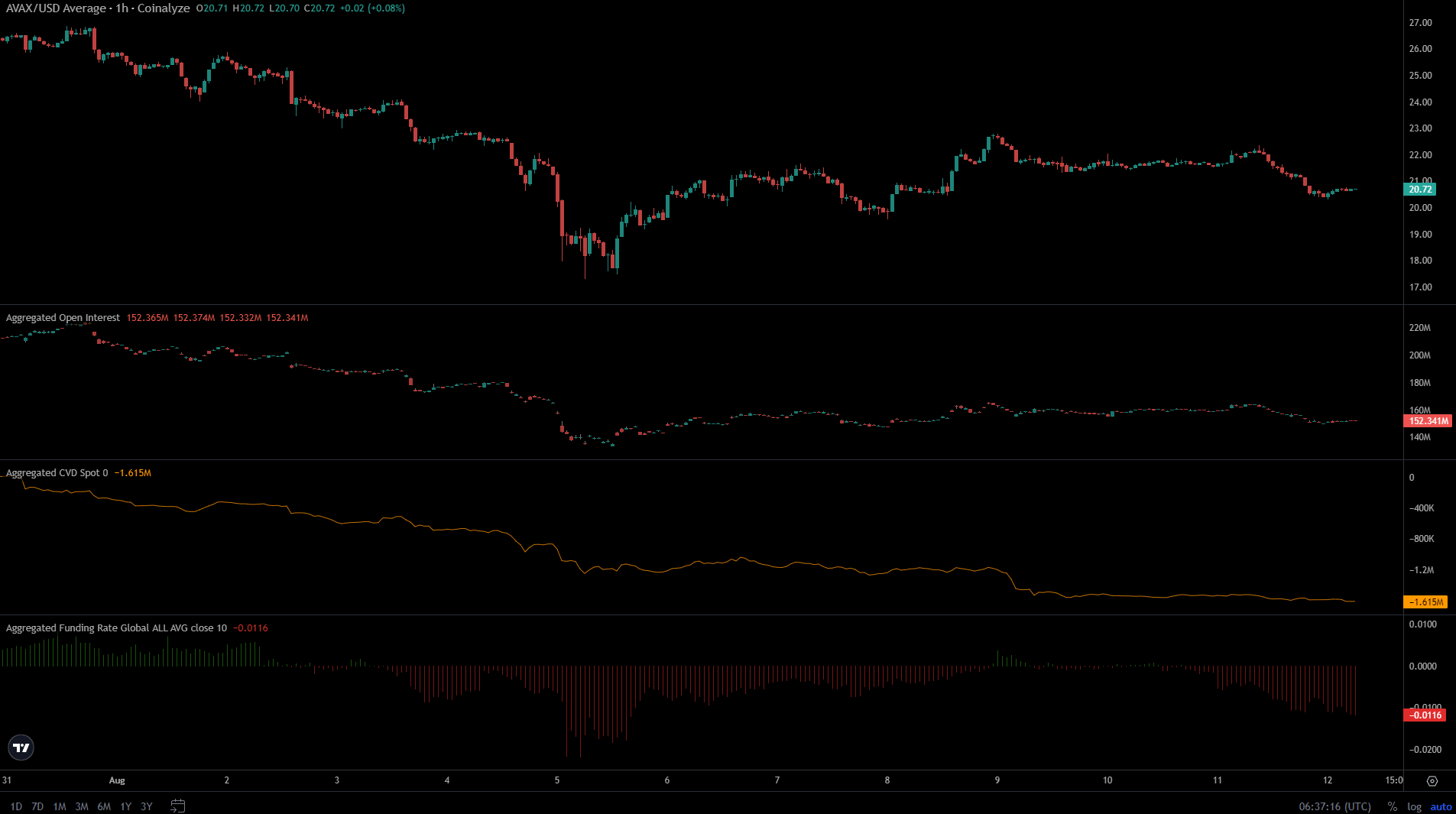

Speculative interest was weak during the price bounce

Source: Coinalyze

The futures market was not hopeful of an Avalanche recovery. When the price reached $22.8 on the 8th of August, the funding rate was just barely positive.

The Open Interest climbed from $152 million to $165 million. It highlighted the lack of bullish conviction in the market despite the price bounce.

Read Avalanche’s [AVAX] Price Prediction 2024-25

Since then, both the OI and the funding rate have dropped lower alongside the price. The spot CVD was in a slow decline.

Together, the short-term market sentiment was bearish, and more losses are expected.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion