- Massive accumulation of Bitcoin by institutions as retail investors panic-sell.

- USDT dominance bearish reversal pattern to trigger Bitcoin rally.

404,448 Bitcoin [BTC], worth $23 billion, were moved to permanent holder addresses over the past 30 days, according to on-chain data, indicating significant accumulation.

Retail investors, distracted by concerns such as the German government selling or Mt. Gox issues, may regret not buying the dip. This missed opportunity is highlighted as institutions are believed to have bought during the recent market dip.

Source: CryptoQuant

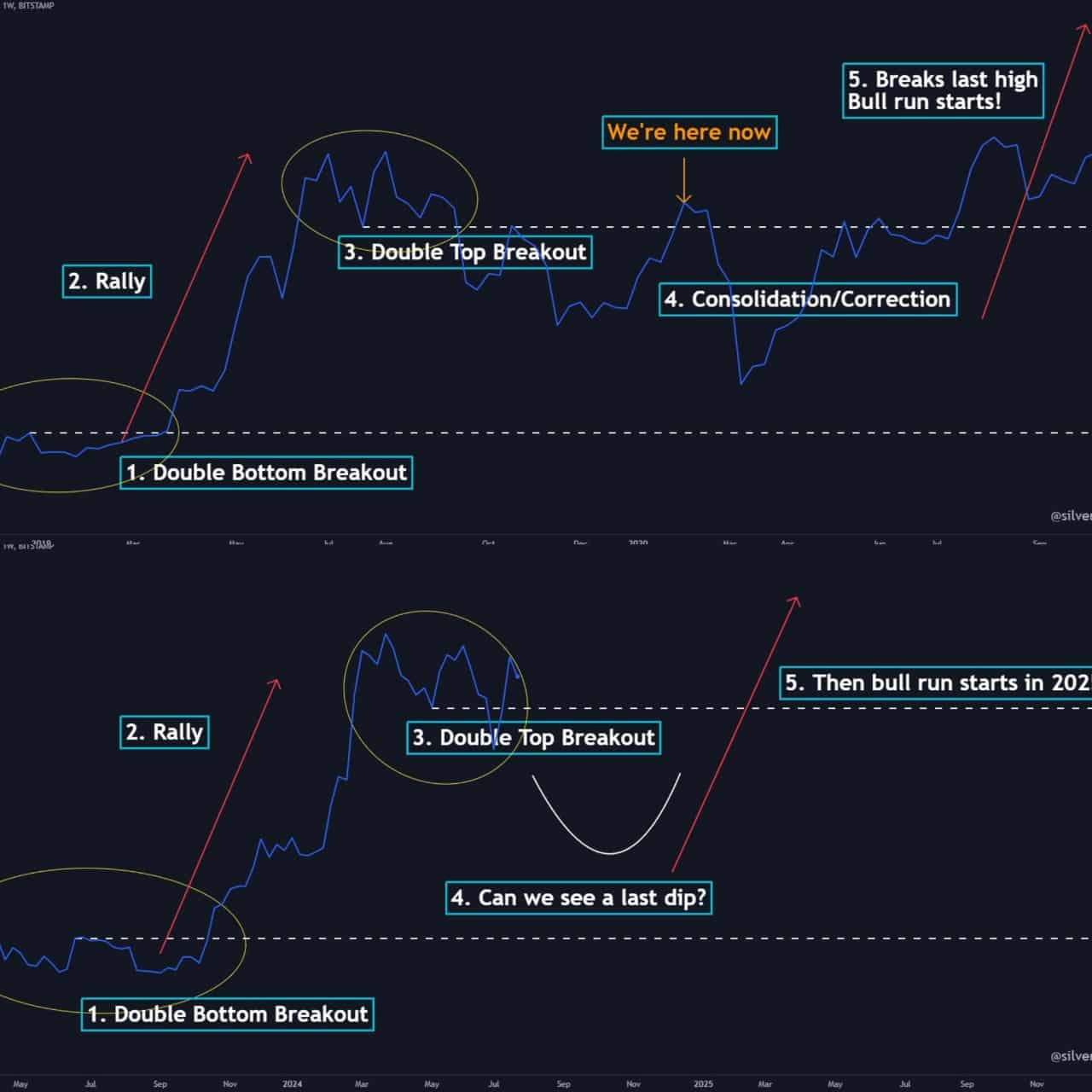

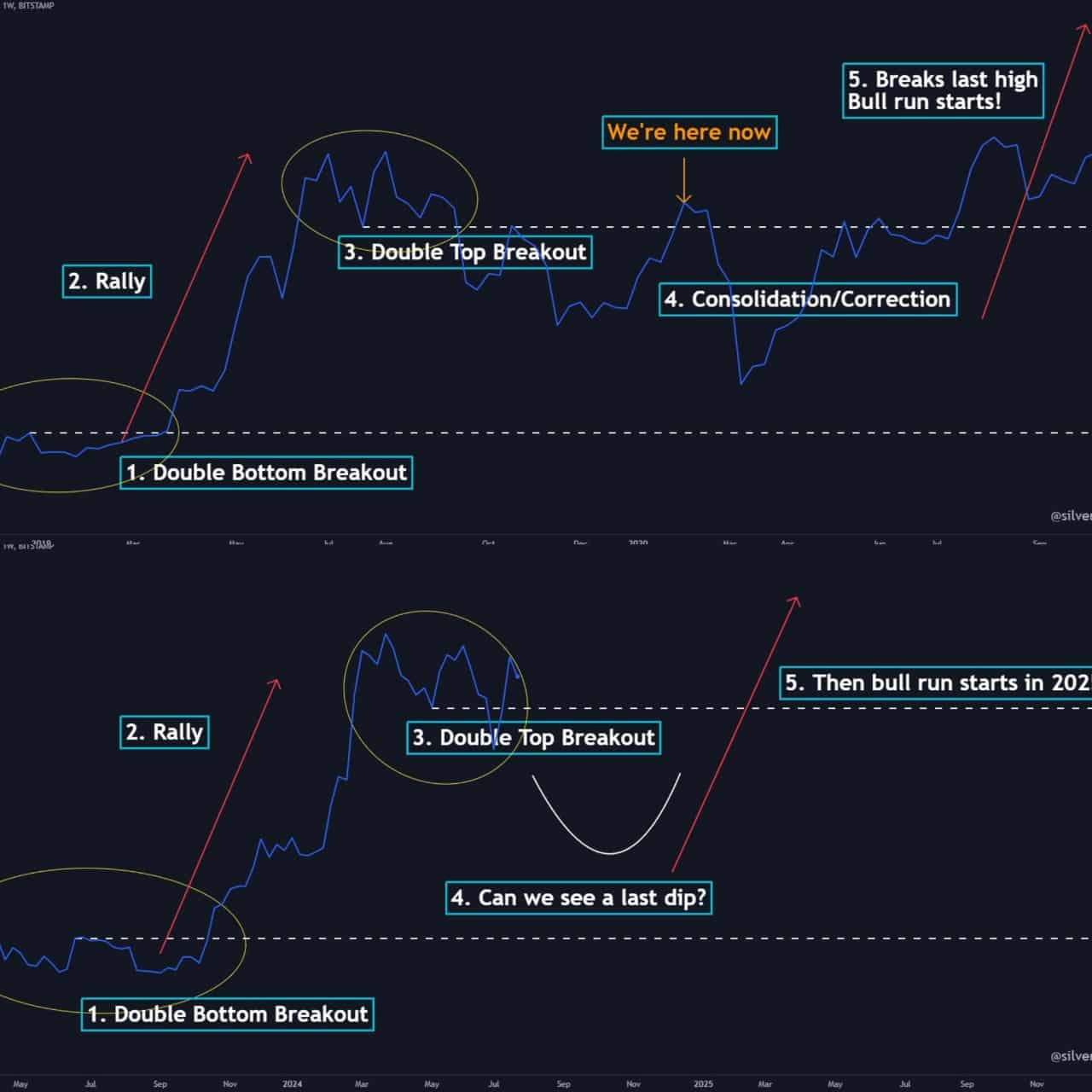

BTC weekly chart mirrors 2019/20 BTC cycle

For weeks, warnings have emerged about investors and traders becoming overly optimistic, ignoring signs on the BTC weekly chart.

This year’s chart resembles the 2019-20 cycle, showing a double bottom, a peak with a double top, a break, a low, and then a rally.

Currently, BTC is in a correction phase, possibly having its last dip before another rally. This phase has attracted significant institutional investments, with many Bitcoins moving to permanent holder addresses.

Are we seeing history repeat itself?

Source: TradingView

USDT dominance falls, Bitcoin rises

When USDT dominance drops, crypto prices often rise. This was evident on ‘Crypto Black Monday’ when $1.7 billion in assets were liquidated.

USDT dominance tested a key resistance and was rejected, indicating a potential shift in market direction.

The 50-day exponential moving average was also retested, confirming the trend reversal. This event highlighted the high volatility of the crypto market and the inherent risks involved.

Source: TradingView

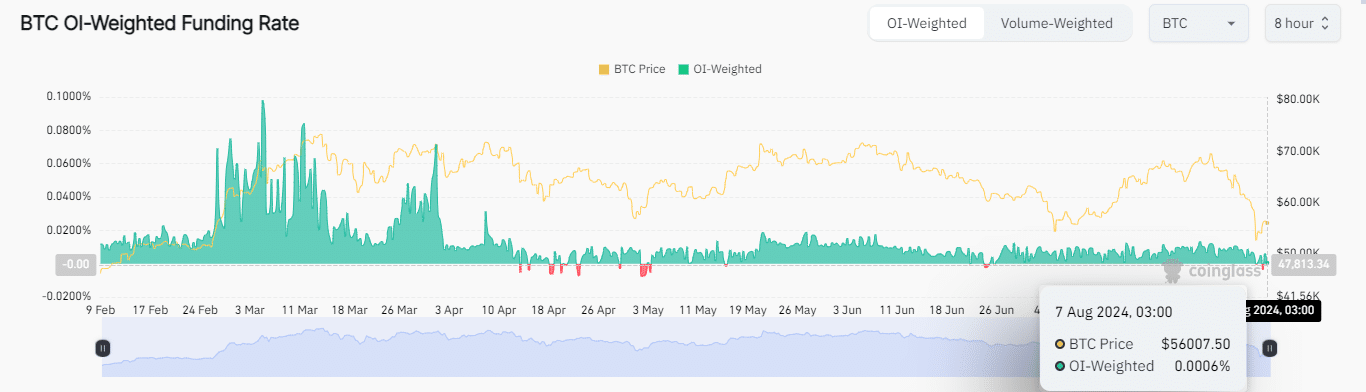

Bitcoin volume-weighted funding rate vs institutional buys show divergence

Divergence occurs when two related metrics move in different directions, signaling a potential market reversal.

Is your portfolio green? Check the Bitcoin Profit Calculator

A falling Bitcoin funding rate suggests a bearish trend, but heavy institutional buying outpacing retail selling indicates a possible reversal.

This market correction might last 4 to 8 weeks, followed by a potential rally in Q3 2024.

Source: Coinglass